媒體聲譽對企業社會責任得獎企業其股市表現與財務績效之影響

96

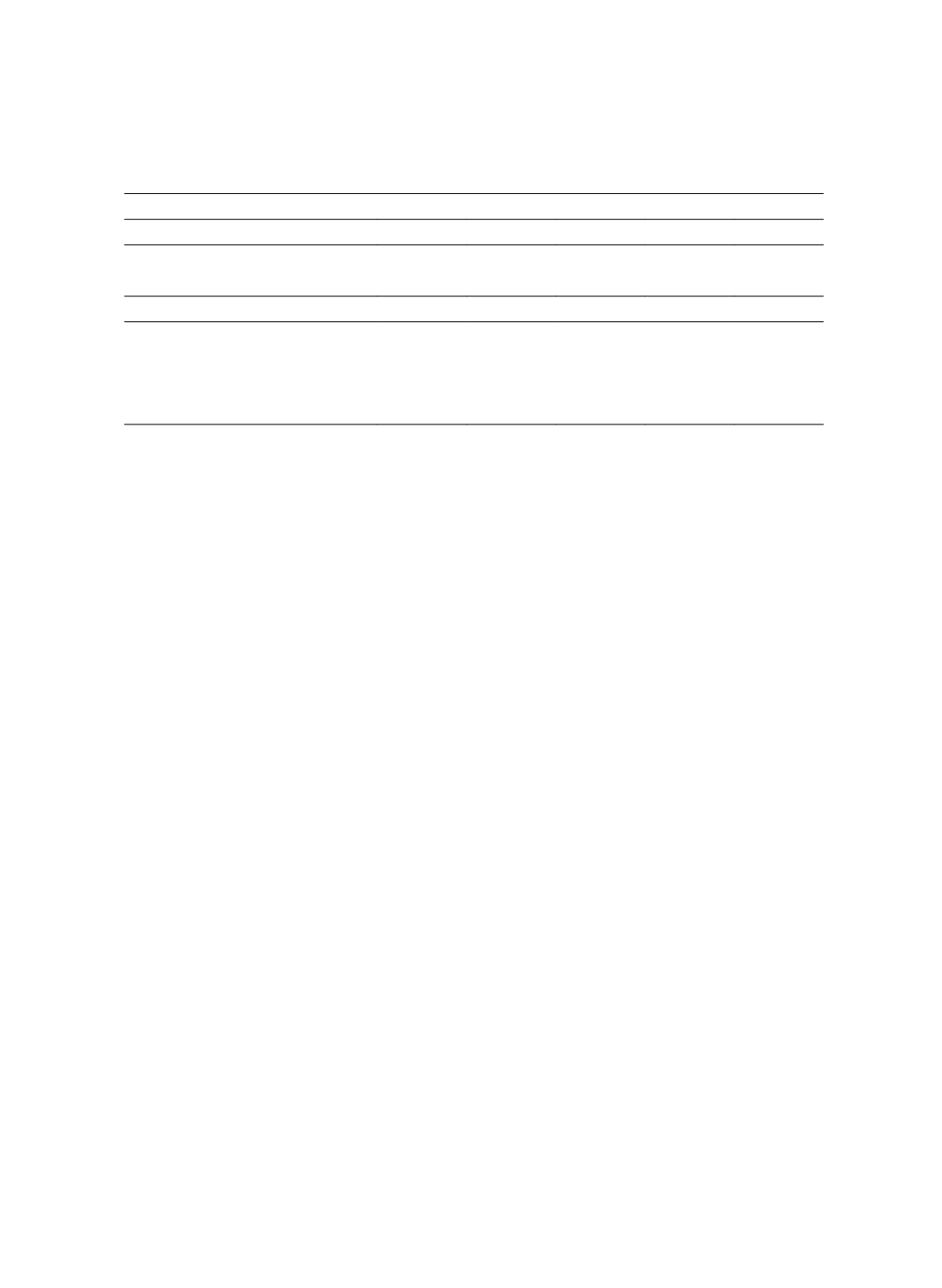

Table 1 Data Sources and Descriptive Statistics

Data Sources

2009

2010

2011

2012

Totals

CommonWealth Magazine

CSR Announcement Date

24 Feb 27 Jul

10 Aug

8 Aug

–

No. of CSR Firms

31

33

33

30

127

Global Views

CSR Announcement Date

4 Mar

4 Mar

10 May

2 May

–

No. of CSR Firms

8

11

4

7

30

Total No. of CSR Firms

39

44

37

37

157

Total No. of non-CSR Firms

102

130

134

132

498

The sources of the financial data used in this study are: (i) the quarterly financial

statements of the listed firms in the Taiwan Economic Journal (TEJ) database and the TEJ

‘event study’ which calculates the ‘cumulative abnormal returns’ (

CAR

); (ii) the news-

corpus information collected from the daily news reports of the InfoTimes database, which

includes the Commercial Times and the China Times; and (iii) the United Daily News

(UDN) database which includes the Economic Daily News and United Evening News.

Both the InfoTimes and the UDN are widely-used media organizations in Taiwan. A total

of 280,531 reports were collected for analysis.

The definitions of CSR and all of the variables used in this study are provided in

Table 2. The financial performance variables include ‘return on assets’ (

ROA

), ‘return on

equity’ (

ROE

), ‘gross profit margin’ (

GPM

), and ‘earnings per share’ (

EPS

). The control

variables include ‘total asset turnover’ (

TAT

), ‘total assets’ (

TA

), ‘debt ratio’ (

DR

),

‘turnover’ (

TURN

), ‘market value’ (

MV

), and ‘price to book ratio’ (

P/B

). The media

proxies include ‘media coverage’ (

MEDIA

), the ‘sentiment ratio’ (

SRso

, which is obtained

by semantic orientation), and ‘media reputation’ (

MR

).