臺大管理論叢

第

26

卷第

2

期

201

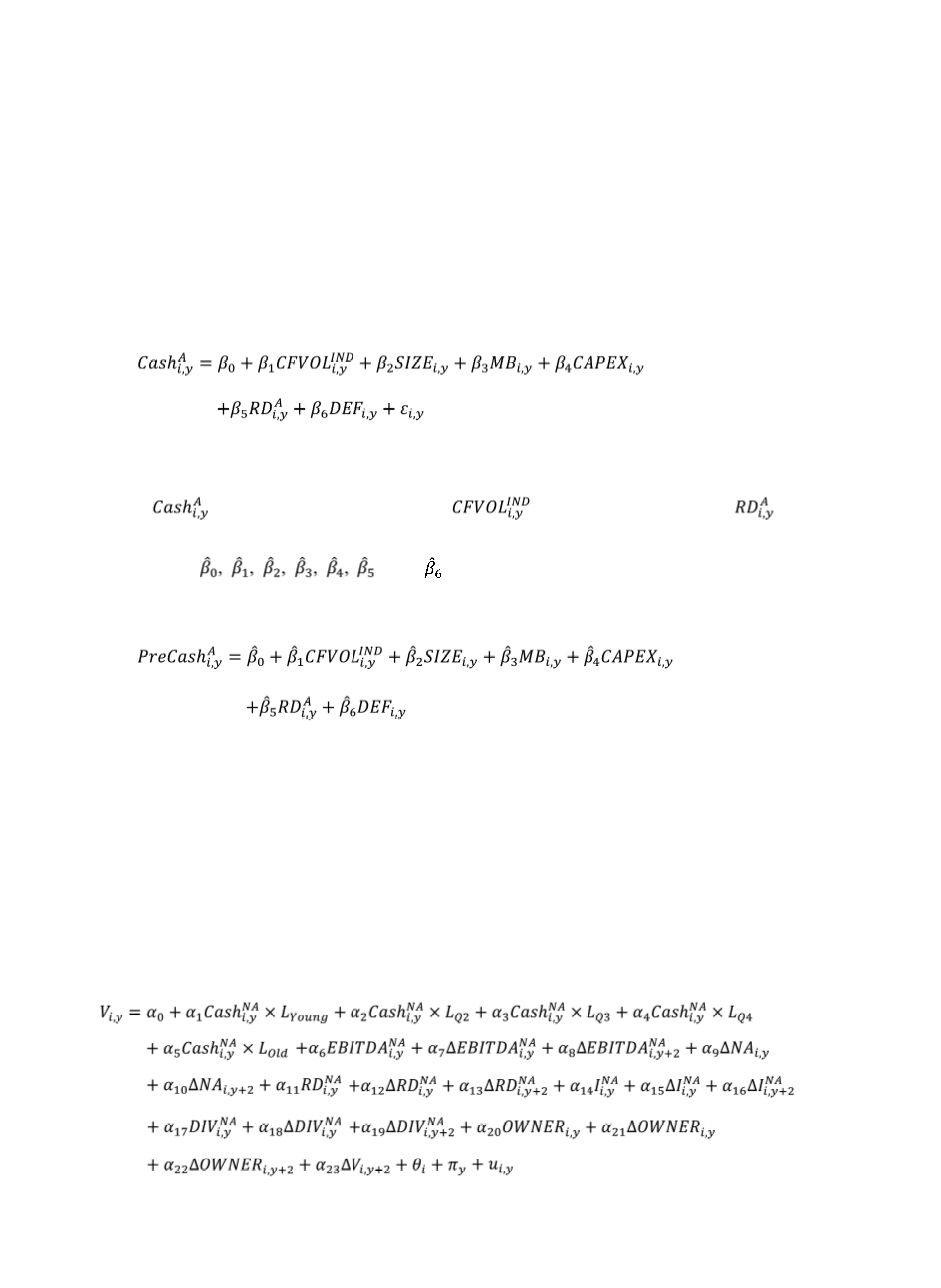

precautionary-predicted and actual cash ratio is NOT significant for young TWSE-listed

firms, while the mature TWSE-listed firms’ precautionary-predicted cash ratios would

significantly exceed their actual cash ratios. The details of the second method are as follows:

(1) we first estimate the following regression model based on Fama and MacBeth (1973)

using firm-year data from 1990 through 1999:

where

y

= 1990, 1991,…, 1999

(2)

where

is firm

i

’s cash ratio in year

y

.

,

SIZE

i,y

,

MB

i,y

,

CAPEX

i,y

,

, and

DEF

i,y

are our precautionary motive proxies in year

y

. (2) We then store the model

coefficients,

, and , and calculate the precautionary-predicted cash

ratio by the following model using firm-year data from 2000 through 2011:

where

y

= 2000, 2001,…, 2011

(3)

(3) We finally sort the entire sample into deciles (denoted as

Young, D2, D3…Mature

) and

test the difference between the means of precautionary-predicted cash ratio and actual cash

ratio for each firm age portfolio.

To test our second hypothesis that young (mature) TWSE-listed firms experience greater

(smaller) cash value, we extend the approach in Fama and French (1998), Pinkowitz and

Williamson (2007), and Bates et al. (2009) by estimating the following regression model:

(4)