保險業集中度及效率對市場競爭程度的影響:以日本產險業為例

314

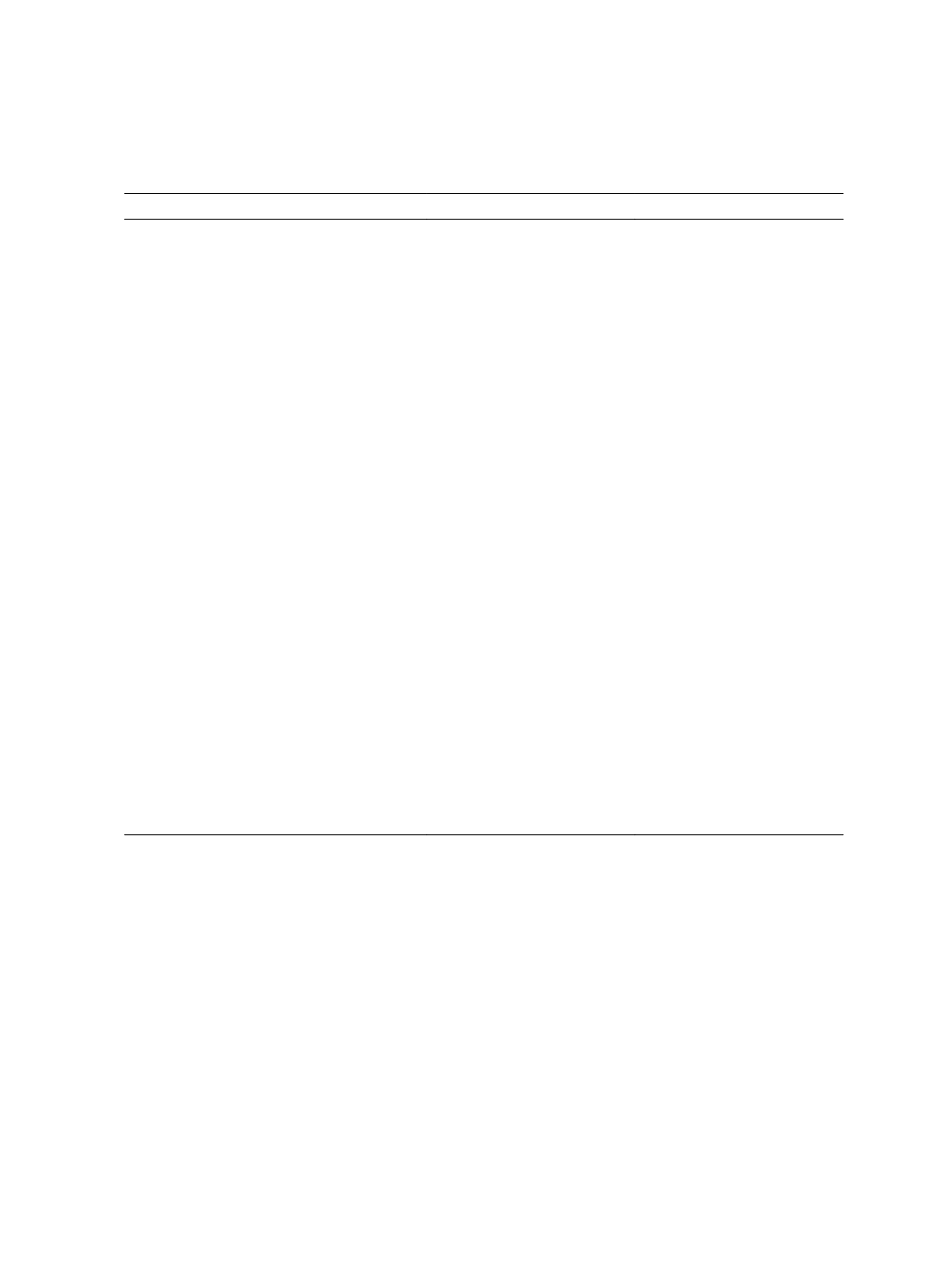

Table 1 Results of Fixed-Effect Regression Models

Variables

(1)

(2)

Intercept

0.000

-0.001

(0.00)

(-0.22)

HHI

1.385***

1.678***

(3.56)

(5.02)

TE

0.065*

(1.66)

PE

0.207***

(10.06)

lnTA

0.212***

0.139***

(3.98)

(3.15)

(lnTA)

2

-0.010***

-0.007***

(-4.04)

(-3.66)

DIV

-0.062*

0.009

(-1.93)

(0.33)

MS

0.866***

0.724***

(3.22)

(3.20)

Auto

-0.053**

-0.033

(-2.15)

(-1.58)

Leverage

0.177***

0.113***

(4.82)

(3.42)

GDP

-0.209

-0.241

(-0.70)

(-0.95)

N

295

283

Adj. R

2

0.184

0.415

Note: 1. The results of technical and profit efficiency are shown in models (1) and (2) respectively.

2. *, **, and *** refer to 10%, 5% and 1% significance levels respectively.

3. We only controlled the firm effect in these regressions as the HHI measures for all firms in

each year are all the same.

The coefficients of market share measure (MS) are both significant at the 1 percent

level in models (1) and (2). This shows that a higher market share increases the market

power of the firm. In addition, the coefficient of the auto line (Auto) is significantly negative,

implying that the higher the value of the main product line, the lower the market power of

the firm. Finally, the coefficient of the leverage ratio is significantly positive. This is

consistent with the result of Fernández de Guevara et al. (2005), implying that firms with

higher risks have a greater market power. The GDP growth, however, is irrelevant to the

market power of the firm.