長期照顧保險商品設計與風險效果分析

200

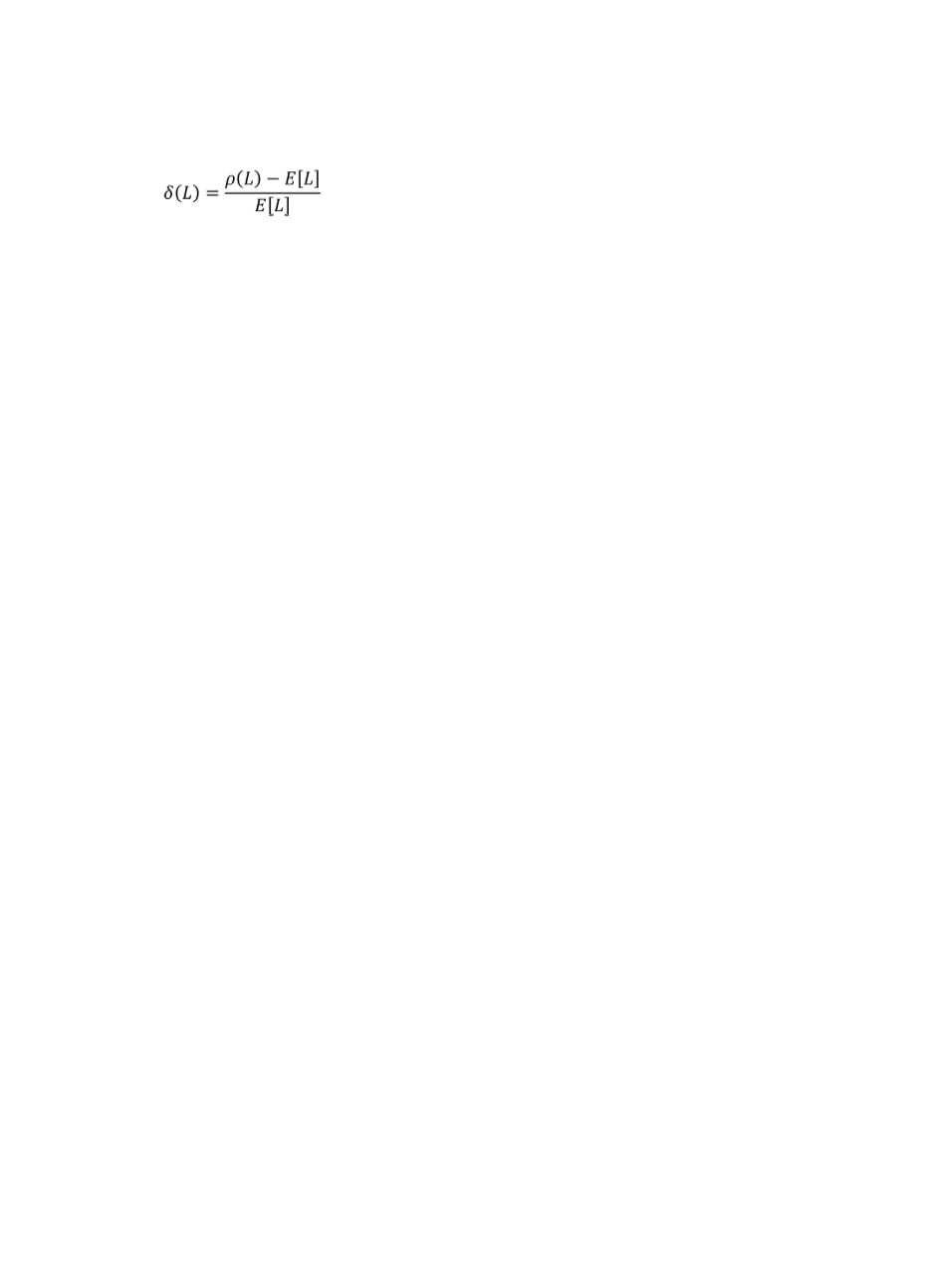

(2)

where

ρ

(

L

) denotes a specific risk measure including different levels of value at risk and

conditional tail expectation, and

E

[

L

] denotes the best estimates.

We then use Monte Carlo simulation to calculate the risk margin. The health statuses are

simulated by a stochastic simulation algorithm for calculating the risk margin

δ

(

L

) in

equation (2) (Glasserman, 2004). We construct multiple health status models by using the

parameter estimates of Pritchard (2006) and compare the risk margin of different product

designs. Specifically, we compare different combinations of long-term care insurance with

annuity or life insurance when selling to the same insured and to different insureds. In

addition, we investigate the adverse selection cost of the annuity. Webb (2009) shows that

the equilibrium of bundled contracts between annuity products and the long-term care

insurance Pareto dominates single contracts. In this paper, we also quantify the benefit of

lowering the adverse selection cost after combining long-term care insurance with annuity.

3. Findings and Conclusion

Based on the proposed models described in the previous section, we investigate the risk

effect of the product design of long-term care insurance. As far as we know, our study is the

first to investigate the risk effect of different long-term care product designs. Our numerical

results show that the combination of long-term care insurance with life insurance can reduce

the risk margin. This effect is due to the correlation of cash flows between long-term care

insurance and life insurance from the same insured. Therefore, we recommend that insurance

companies sell a combination of long-term care products with life insurance at a lower total

price and not to sell these policies separately.

By contrast, the combination of long-term care insurance with annuity increases the risk

margin. However, when the adverse selection cost of the annuity is further considered in the

analysis, the net risk effect of the combination of long-term care insurance with annuity

actually decreases, because the benefit of lowering the adverse selection cost outweighs the

increasing risk margin. Therefore, our results also suggest that integrating annuity and long-

term care insurance can lower the price of combined products to increase the demand for

both annuity and long-term care insurance.