Page 111 - 34-1

P. 111

NTU Management Review Vol. 34 No. 1 Apr. 2024

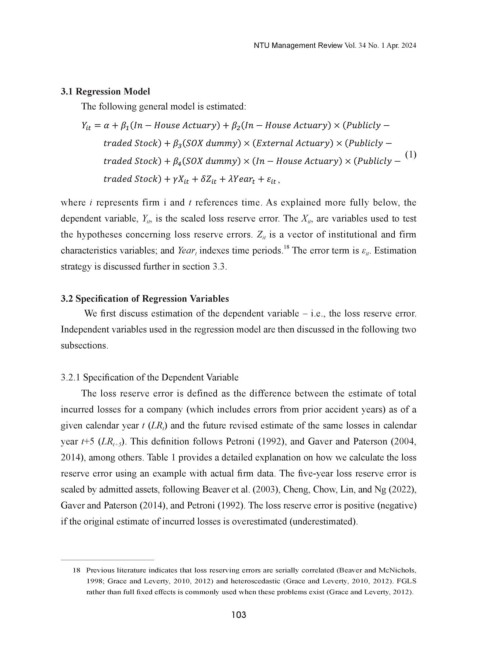

3.1 Regression Model

The following general model is estimated:

×

× ×

(1)

× ×

,

where i represents firm i and t references time. As explained more fully below, the

dependent variable, Y , is the scaled loss reserve error. The X , are variables used to test

it

it

the hypotheses concerning loss reserve errors. Z is a vector of institutional and firm

it

characteristics variables; and Year indexes time periods. The error term is ε . Estimation

18

t

it

strategy is discussed further in section 3.3.

3.2 Specification of Regression Variables

We first discuss estimation of the dependent variable – i.e., the loss reserve error.

Independent variables used in the regression model are then discussed in the following two

subsections.

3.2.1 Specification of the Dependent Variable

The loss reserve error is defined as the difference between the estimate of total

incurred losses for a company (which includes errors from prior accident years) as of a

given calendar year t (LR ) and the future revised estimate of the same losses in calendar

t

year t+5 (LR ). This definition follows Petroni (1992), and Gaver and Paterson (2004,

t+5

2014), among others. Table 1 provides a detailed explanation on how we calculate the loss

reserve error using an example with actual firm data. The five-year loss reserve error is

scaled by admitted assets, following Beaver et al. (2003), Cheng, Chow, Lin, and Ng (2022),

Gaver and Paterson (2014), and Petroni (1992). The loss reserve error is positive (negative)

if the original estimate of incurred losses is overestimated (underestimated).

18 Previous literature indicates that loss reserving errors are serially correlated (Beaver and McNichols,

1998; Grace and Leverty, 2010, 2012) and heteroscedastic (Grace and Leverty, 2010, 2012). FGLS

rather than full fixed effects is commonly used when these problems exist (Grace and Leverty, 2012).

103