17

臺大管理論叢

第

28

卷第

1

期

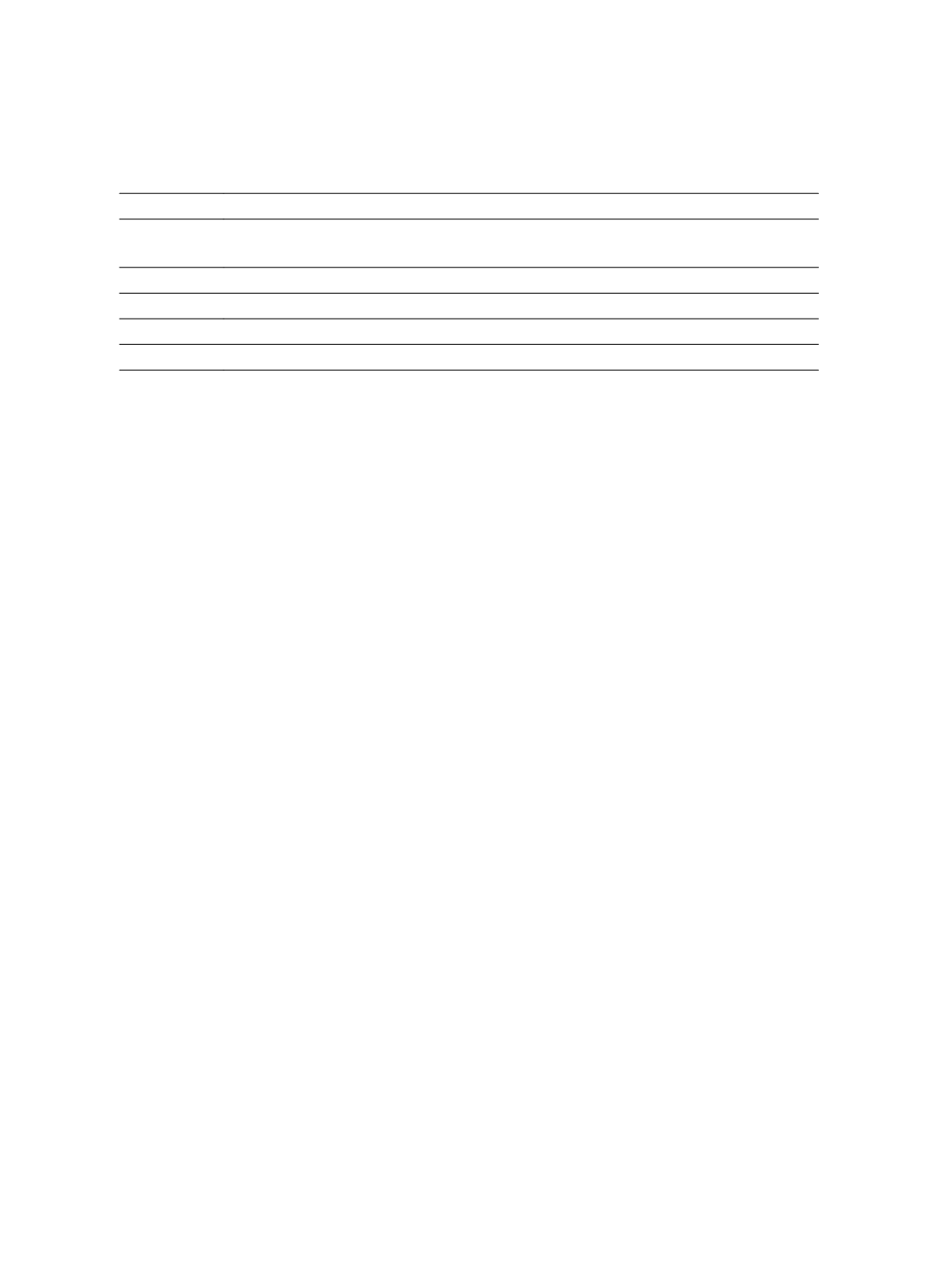

INDEP

The proportion of independent directors.

DUAL

An indicator variable that equals one if the CEO also serves as chairman of the

board and zero otherwise.

DEV

The ratio of cash flow rights to control rights.

SALES_R

Related party sales over total sales.

INST

The percentage of common stocks held by institutional investors.

IMR

The inverse Mills ratio generated from the first-stage Probit regression model (3).

The second set of control variables (

ROA, NOL, and ∆NOI

) captures a firm’s

profitability and the presence of net operating loss. More profitable firms tend to have

higher effective tax rates (Chen et al., 2010), but they may have more incentives to be

engaged in tax avoidance (Rego, 2003; Wilson, 2009). Firms with net operating loss may

entail tax loss carryback or carryforward which affects the effective tax rates. The third set

of control variables (

STD_ROA and ∆SALES

) captures performance volatility. It could be

more difficult for firms with higher performance volatility to manage tax saving plan

(Cazier, Rego, Tian, and Wilson, 2009). The fourth set of control variables (

CASH, PPE,

INTAN, RD, ADV, and SGA

) captures a firm’s asset mix and expenditures that could

impact its ETRs. In particular, we control for the level of firms’ cash holdings to account

for firms’ cash needs that might be necessary for certain types of tax avoidance (McGuire,

Omer, and Wang, 2012); the tax code typically allows corporations to take depreciation

expense on property, plant, and equipments over periods much shorter than their economic

lives. Thus, more capital-intensive firms are expected to have lower ETRs (Gupta and

Newberry, 1997); the tax code also grants corporations the differential book and tax

treatments of intangible assets and RandD expenditures. RandD intensive firms are

especially affected by RandD-encouraging tax credit (Chen et al., 2010; Grubert and

Slemrod, 1998). We also include firms’ advertising expense and SGandA expense since

firms can manage tax avoidance plans via discretional spending such as advertising

expenses and selling, general, and administrative expense (Dyreng et al., 2010). Finally,

we control the number of investees of a firm since firms with more investees can use

transfer pricing and income shifting among the parent and investees to reduce tax burden.

We also control for firms’ industry and year because firm-specific characteristics might

vary systematically by industry and economic environment over time (Rego, 2003).