Page 38 - 34-1

P. 38

Valuation of Spread and Basket Options

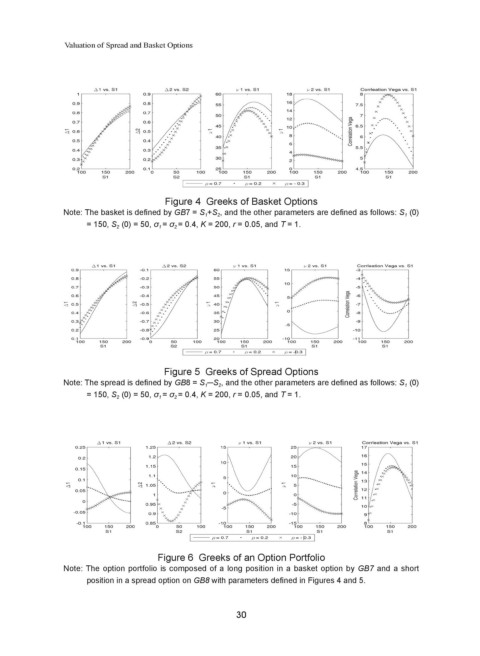

Figure 4 Greeks of Basket Options

Note: The basket is defined by GB7 = S 1 +S 2 , and the other parameters are defined as follows: S 1 (0)

= 150, S 2 (0) = 50, σ 1 = σ 2 = 0.4, K = 200, r = 0.05, and T = 1.

Figure 5 Greeks of Spread Options

Note: The spread is defined by GB8 = S 1 ─S 2 , and the other parameters are defined as follows: S 1 (0)

= 150, S 2 (0) = 50, σ 1 = σ 2 = 0.4, K = 200, r = 0.05, and T = 1.

Figure 6 Greeks of an Option Portfolio

Note: The option portfolio is composed of a long position in a basket option by GB7 and a short

position in a spread option on GB8 with parameters defined in Figures 4 and 5.

30