Page 34 - 34-1

P. 34

Valuation of Spread and Basket Options

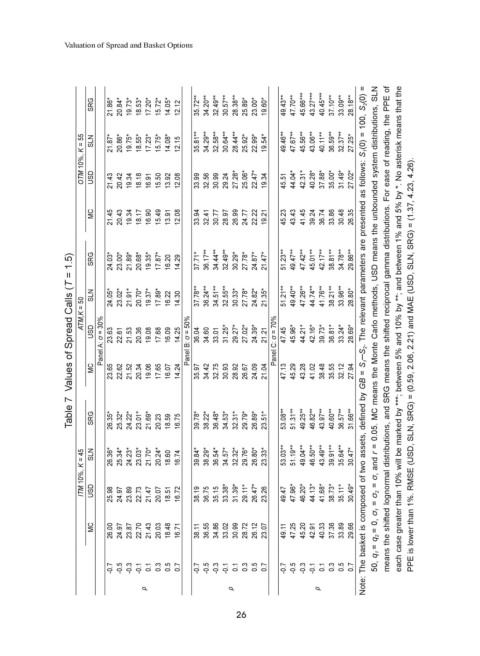

SRG 21.86* 20.84* 19.73* 18.53* 17.20* 15.72* 14.05* 12.12 35.72** 34.20** 32.49** 30.57** 28.38** 25.89* 23.00* 19.60* 49.43** 47.70** 45.66*** 43.27*** 40.45*** 37.10** 33.09** 28.18**

OTM 10%, K = 55 SLN USD 21.87* 21.43 20.86* 20.42 19.75* 19.34 18.55* 18.18 17.23* 16.91 15.75* 15.50 14.08* 13.92 12.15 12.08 35.81** 33.99 34.29** 32.56 32.58** 30.99 30.64** 29.24 28.44** 27.28* 25.92* 25.06* 22.99* 22.47* 19.54* 19.34 49.46** 45.51 47.67** 44.04* 45.56** 42.31* 43.06** 40.28* 40.11** 37.88* 36.59** 35.00* 32.37** 31.49* 27.25* 27.02*

MC 21.45 20.43 19.34 18.17 16.90 15.49 13.91 12.08 33.94 32.41 30.77 28.97 26.99 24.77 22.22 19.21 45.23 43.43 41.45 39.24 36.74 33.86 30.48 26.35

SRG 24.03* 23.00* 21.89* 20.68* 19.35* 17.87* 16.20 14.29 37.71* 36.17** 34.44** 32.49** 30.29* 27.78* 24.87* 21.47* 51.23** 49.47** 47.42** 45.01** 42.17** 38.81** 34.78** 29.86**

Table 7 Values of Spread Calls (T = 1.5)

SLN 24.05* 23.02* 21.91* 20.70* 19.37* 17.89* 16.22 14.30 37.78** 36.24** 34.51** 32.55** 30.33* 27.78* 24.82* 21.35* 51.21** 49.40** 47.26** 44.74** 41.76** 38.21** 33.96** 28.80*

ATM,K = 50

USD Panel A: σ = 30% 23.63 22.61 21.53 20.36 19.08 17.68 16.09 14.25 Panel B: σ = 50% 36.04 34.60 33.01 31.25* 29.27* 27.02* 24.39* 21.21 Panel C: σ = 70% 47.45 45.96* 44.21* 42.16* 39.73* 36.81* 33.24* 28.69* Note: The basket is composed of two assets, defined by GB = S 1 ─S 2 . The relevant parameters are presented as follows: S 1 (0) = 100, S 2 (0) = 50, q 1 = q 2 = 0, σ

MC 23.65 22.62 21.52 20.34 19.06 17.65 16.07 14.24 35.97 34.42 32.75 30.93 28.92 26.67 24.09 21.04 47.13 45.29 43.28 41.02 38.48 35.55 32.12 27.94 PPE is lower than 1%. RMSE (USD, SLN, SRG) = (0.59, 2.06, 2.21) and MAE (USD, SLN, SRG) = (1.37, 4.23, 4.26).

SRG 26.35* 25.32* 24.22* 23.01* 21.69* 20.23 18.59 16.75 39.78* 38.22* 36.48* 34.53* 32.31* 29.79* 26.89* 23.51* 53.08** 51.31** 49.25** 46.82** 43.97** 40.60** 36.57** 31.66**

ITM 10%, K = 45 SLN USD 26.36* 25.98 25.34* 24.97 24.23* 23.89 23.03* 22.73 21.70* 21.47 20.24* 20.07 18.60 18.51 16.74 16.72 39.84* 38.19 38.29* 36.75 36.54* 35.15 34.57* 33.38* 32.32* 31.39* 29.76* 29.11* 26.80* 26.47* 23.33* 23.26 53.03** 49.47 51.19** 47.96* 49.04** 46.20* 46.50** 44.13* 43.49** 41.68* 39.91** 38.73* 35.64** 35.11* 30.47* 30.49*

MC 26.00 24.97 23.87 22.70 21.43 20.03 18.48 16.71 38.11 36.55 34.86 33.02 30.99 28.72 26.12 23.07 49.11 47.25 45.20 42.91 40.33 37.36 33.89 29.66

-0.7 -0.5 -0.3 -0.1 0.1 0.3 0.5 0.7 -0.7 -0.5 -0.3 -0.1 0.1 0.3 0.5 0.7 -0.7 -0.5 -0.3 -0.1 0.1 0.3 0.5 0.7

ρ ρ ρ

26