Page 37 - 34-1

P. 37

NTU Management Review Vol. 34 No. 1 Apr. 2024

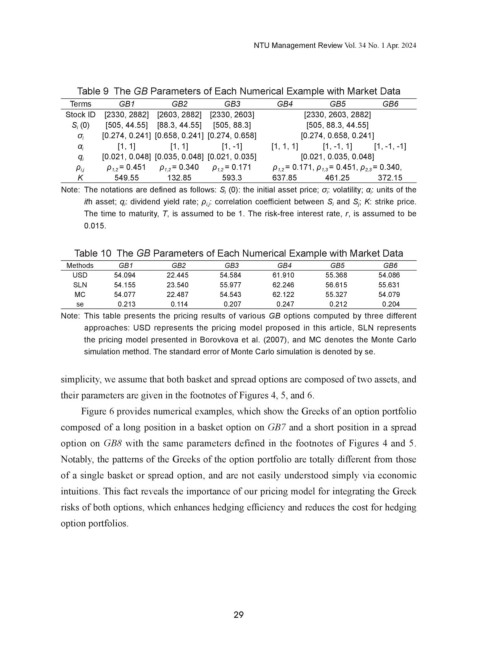

Table 9 The GB Parameters of Each Numerical Example with Market Data

Terms GB1 GB2 GB3 GB4 GB5 GB6

Stock ID [2330, 2882] [2603, 2882] [2330, 2603] [2330, 2603, 2882]

S i (0) [505, 44.55] [88.3, 44.55] [505, 88.3] [505, 88.3, 44.55]

[0.274, 0.241] [0.658, 0.241] [0.274, 0.658] [0.274, 0.658, 0.241]

σ i

[1, 1] [1, 1] [1, -1] [1, 1, 1] [1, -1, 1] [1, -1, -1]

α i

[0.021, 0.048] [0.035, 0.048] [0.021, 0.035] [0.021, 0.035, 0.048]

q i

ρ 1,2 = 0.451 ρ 1,2 = 0.340 ρ 1,2 = 0.171 ρ 1,2 = 0.171, ρ 1,3 = 0.451, ρ 2,3 = 0.340,

ρ i,j

K 549.55 132.85 593.3 637.85 461.25 372.15

Note: The notations are defined as follows: S i (0): the initial asset price; σ i : volatility; α i : units of the

ith asset; q i : dividend yield rate; ρ i,j : correlation coefficient between S i and S j ; K: strike price.

The time to maturity, T, is assumed to be 1. The risk-free interest rate, r, is assumed to be

0.015.

Table 10 The GB Parameters of Each Numerical Example with Market Data

Methods GB1 GB2 GB3 GB4 GB5 GB6

USD 54.094 22.445 54.584 61.910 55.368 54.086

SLN 54.155 23.540 55.977 62.246 56.615 55.631

MC 54.077 22.487 54.543 62.122 55.327 54.079

se 0.213 0.114 0.207 0.247 0.212 0.204

Note: This table presents the pricing results of various GB options computed by three different

approaches: USD represents the pricing model proposed in this article, SLN represents

the pricing model presented in Borovkova et al. (2007), and MC denotes the Monte Carlo

simulation method. The standard error of Monte Carlo simulation is denoted by se.

simplicity, we assume that both basket and spread options are composed of two assets, and

their parameters are given in the footnotes of Figures 4, 5, and 6.

Figure 6 provides numerical examples, which show the Greeks of an option portfolio

composed of a long position in a basket option on GB7 and a short position in a spread

option on GB8 with the same parameters defined in the footnotes of Figures 4 and 5.

Notably, the patterns of the Greeks of the option portfolio are totally different from those

of a single basket or spread option, and are not easily understood simply via economic

intuitions. This fact reveals the importance of our pricing model for integrating the Greek

risks of both options, which enhances hedging efficiency and reduces the cost for hedging

option portfolios.

29