261

臺大管理論叢

第

28

卷第

2

期

exclude observations which SG&A costs are missing, we do not require that all cost

variables to be jointly available but only those that are required in each test. The average

(median) firm in our sample reported sales revenue of $834 ($91) million dollars of sales,

$151 ($20) million dollars of selling, general and administrative costs. Note that the mean

(median) value of

CC

, variable that measures cost concentration, is 0.104 (0.051) in our

sample, and interquartile range is from 0.017 to 0.131. This shows significant variation in

customer-based concentration among supplier firms in our sample. The mean and median

of

CC

is similar to that in Patatoukas (2012) and Chang et al. (2015).

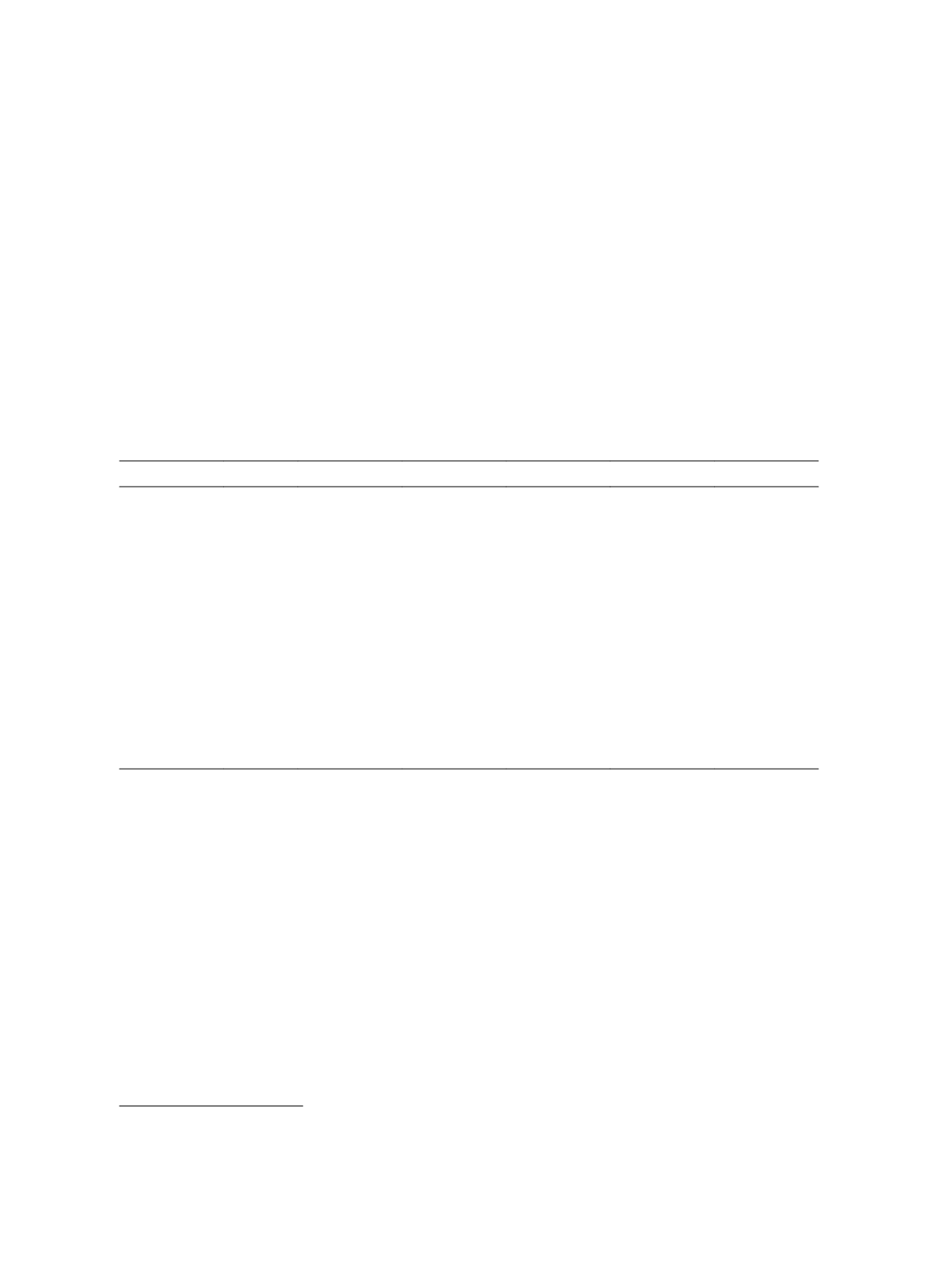

Table 1 Descriptive Statistics

Variable

N

Mean

Std. Dev.

Q1

Median

Q3

SALE

47,452 834.0031 2395.7024 20.2625

90.6185 450.7840

OC

47,452 700.7037 1968.5846 20.3945

82.7415 391.1820

SGA

47,452 150.6157

439.0183

5.5400

20.3060

80.6670

COGS

47,452 527.4510 1502.6128 11.9610

55.1570 280.2820

EMP

47,452

4.3292

16.0825

0.1420

0.5540

2.5000

CC

47,452

0.1043

0.1440

0.0169

0.0507

0.1308

SIZE

47,452

4.5701

2.2294

3.0088

4.5067

6.1110

RD

47,452

0.0643

0.1683

0

0.0195

0.0807

FCF

38,795

5

-0.0156

0.7321 -0.0266

0.0525

0.1079

ASINT

47,452

1.4181

35.4726

0.6399

0.8743

1.2924

EMPINT

47,452

0.0089

0.0113

0.0037

0.0064

0.0110

Table 2 present correlations among variables used in my test. Pearson (Spearman)

correlation is reported in the upper (lower) part of the table. Sale is highly positively

correlated with selected cost variables (

SGA, COGS,

and

OC

), which indicates that using

sales as cost driver is appropriate. Note that

Size

is negatively correlated with

CC

, which

can be explained that smaller firms have more concentrated customer bases.

5 Free Cash Flows (

FCF

) is measured as cash flow from operating activities minus common and

preferred dividends, scaled by total assets. As the cash flow from operating activities (Compustat item

OANCF) is available on Compustat only since 1988, thus some firm-year observations are missing.