沙賓法

404

條及審計準則第

5

號是否會減少內部控制揭露錯誤?

268

Prior studies indicate that the existence of internal control deficiencies is associated

with company size, operating loss, business risk, company growth, the appointment of a

Big-4 auditor, restructuring charges, and the incidence of foreign transactions (Ge and

McVay, 2005; Ashbaugh-Skaife et al., 2007; Doyle, Ge, and McVay, 2007b). Also

consistent with prior studies, we control for companies size with natural log of total assets

(

SIZE

) and market capitalization (

MARKETCAP

). We proxy operating loss with return on

assets (

ROA

) and aggregate loss (

AGLOSS

). We proxy business risk with leverage (

LEV

).

Company growth is controlled with price-to-earnings (

PE

) and market-to-book (MB)

ratios. The appointment of a Big-4 auditor (

BIGN

), restructuring charges (

RCP

), and the

incidence of foreign transactions (

FT

) are also controlled in our models.

YEAR

is a set of

dummy variables separately representing each of the fiscal years. Finally, we include a set

of 13 industry-indicator variables (

INDUSTRY

) based on Frankel, Johnson, and Nelson

(2002). To mitigate the effect of extreme values, we winsorize all of the continuous

variables at the 0.01 and 0.99 percentiles. Table 2 shows our variable definitions.

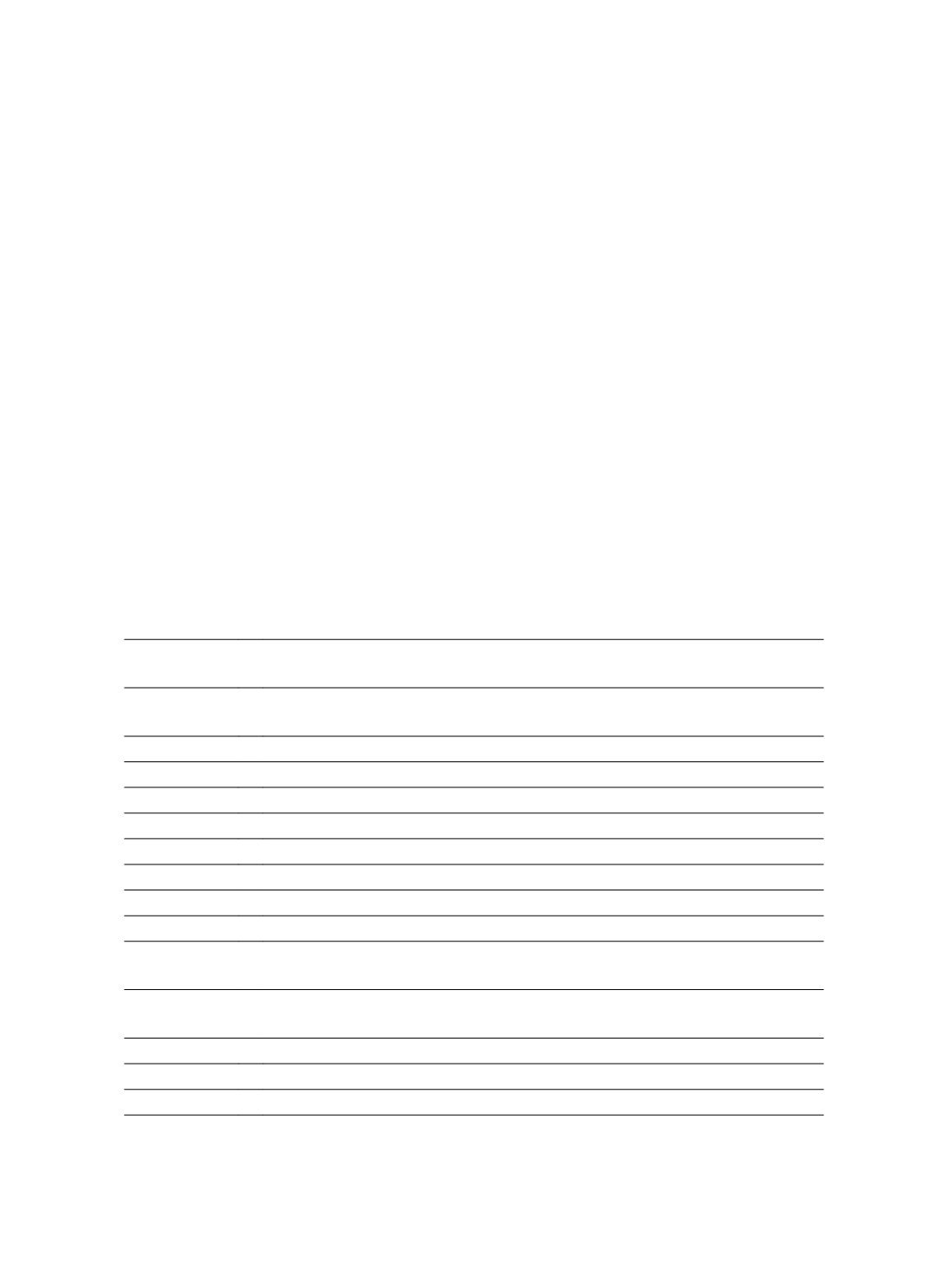

Table 2 Variable Definitions

EFFECTIVE

=

dummy variable coded 1 if a company concludes that its internal-

controlinternal control system is effective in its 10-K filing and 0 otherwise

SOX404

=

dummy variable with a value of 1 if a company is subject to the SOX 404

regulation and 0 otherwise

AS5

= dummy variable coded 1 if AS5 is applicable to a company and 0 otherwise

SIZE

= natural log of total assets in the unit of million dollars

ROA

= net income before extraordinary items divided by total assets

LEV

= total liabilities divided by total assets

PE

= year-end share price divided by earnings per share

MB

= year-end market value divided by book value

BIGN

= dummy variable coded 1 if the appointed auditor is a - auditor and 0 otherwise

RCP

= aggregate restructuring charges

FT

=

indicator variable coded 1 if a company has a non-zero foreign currency

translation and 0 otherwise

AGLOSS

=

dummy variable coded 1 if earnings before extraordinary items in years

t

and

t

-1 sum to less than zero and 0 otherwise

MARKETCAP

= natural log of share price multiplied by number of outstanding shares

YEAR

= a set of year dummy variables

INDUSTRY

= a set of 13 industry-indicator variables based on Frankel et al. (2002)