沙賓法

404

條及審計準則第

5

號是否會減少內部控制揭露錯誤?

266

Annual files, resulting in 50,304 company-year observations. Next, we delete foreign

companies, non-accelerated filers that are exempted from compliance with SOX 404, and

companies without necessary data for our empirical analysis. Further, prior studies show

that to circumvent compliance with SOX 404, companies may choose to stay small, go

private, or “go dark” (Gao, Wu, and Zimmerman, 2009; Engel, Hayes, and Wang, 2007;

Leuz, Triantis, and Wang, 2008). The incentives to circumvent the compliance of SOX

404 may have an effect on ICFR-disclosure quality; therefore, we drop companies which

had failed to consistently meet the accelerated-filer criteria (companies whose public float

is 75 million or more, as of six months before the fiscal year-end) during the period of

2004–2010. Finally, our sample covers 12,627 company-year observations. Table 1 shows

our sample-selection procedures and the sample composition in detail.

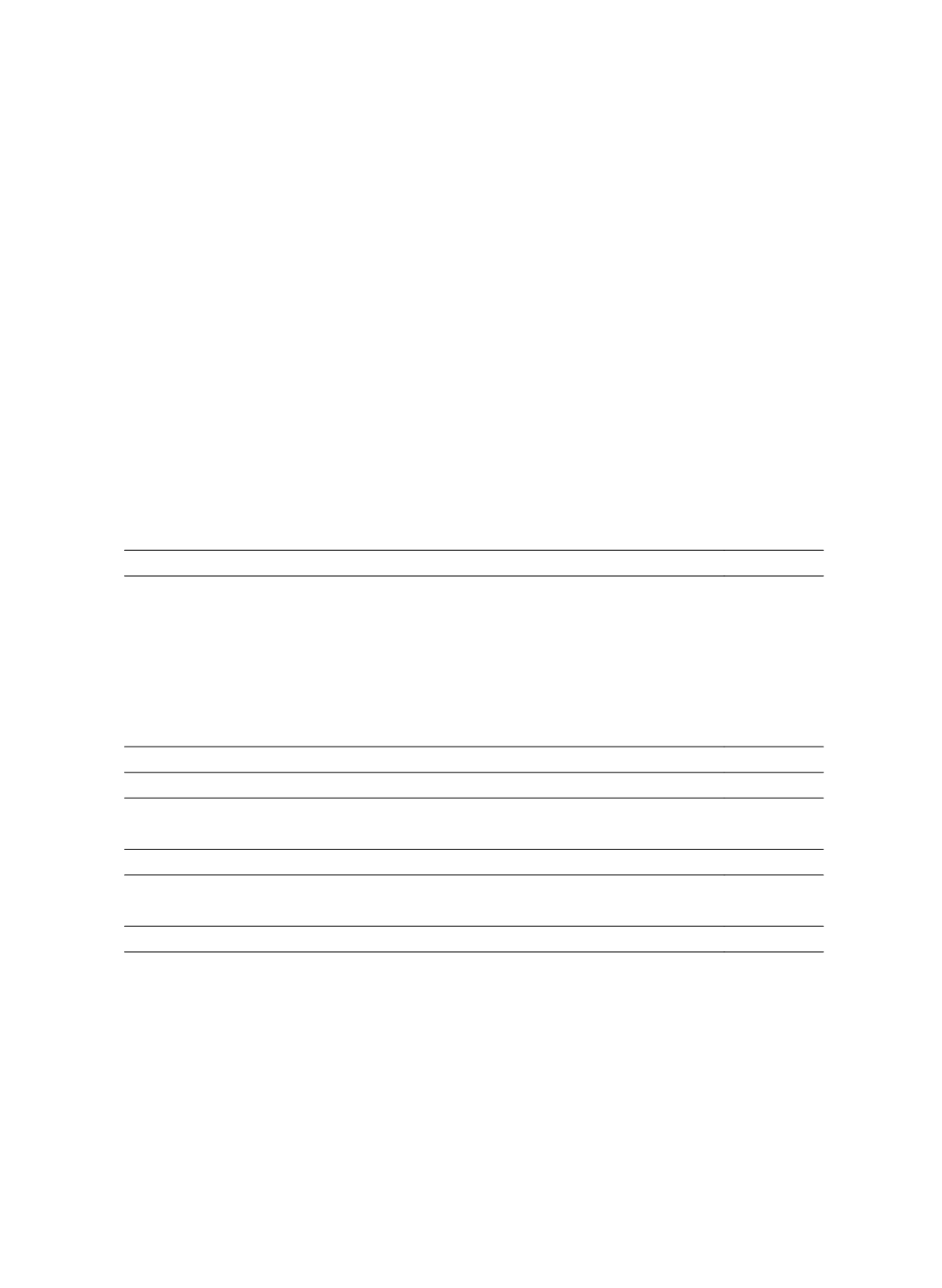

Table 1 Sample Selection and Composition

Panel A: Sample Selection

Initial sample of company-year observations covered by both Analytics and

Compustat from the period 2002–2010

50,304

Less: Foreign-company observations

(1,220)

Less: Companies observations without necessary data for our empirical analyses

(7,381)

Less: Non-accelerated filers

Less: Companies that did not continuously meet the accelerated-filer criteria from

the period 2004–2010

(10,555)

(18,521)

Final Sample

12,627

Panel B: Sample Composition

Company-year observations under the SOX 302 regime

2,722

Company-year observations under the SOX 404 regime

9,905

Total

12,627

Company-year observations to which AS2 is applicable

4,245

Company-year observations to which AS5 is applicable

5,660

Total company observations undergoing ICFR audits in our sample

9,905

3.2 Estimation Models

We use logistic regression to estimate the following models and the likelihood of a

company concluding that its internal controls are effective: