消費者情緒在九尾數定價效果的影響

240

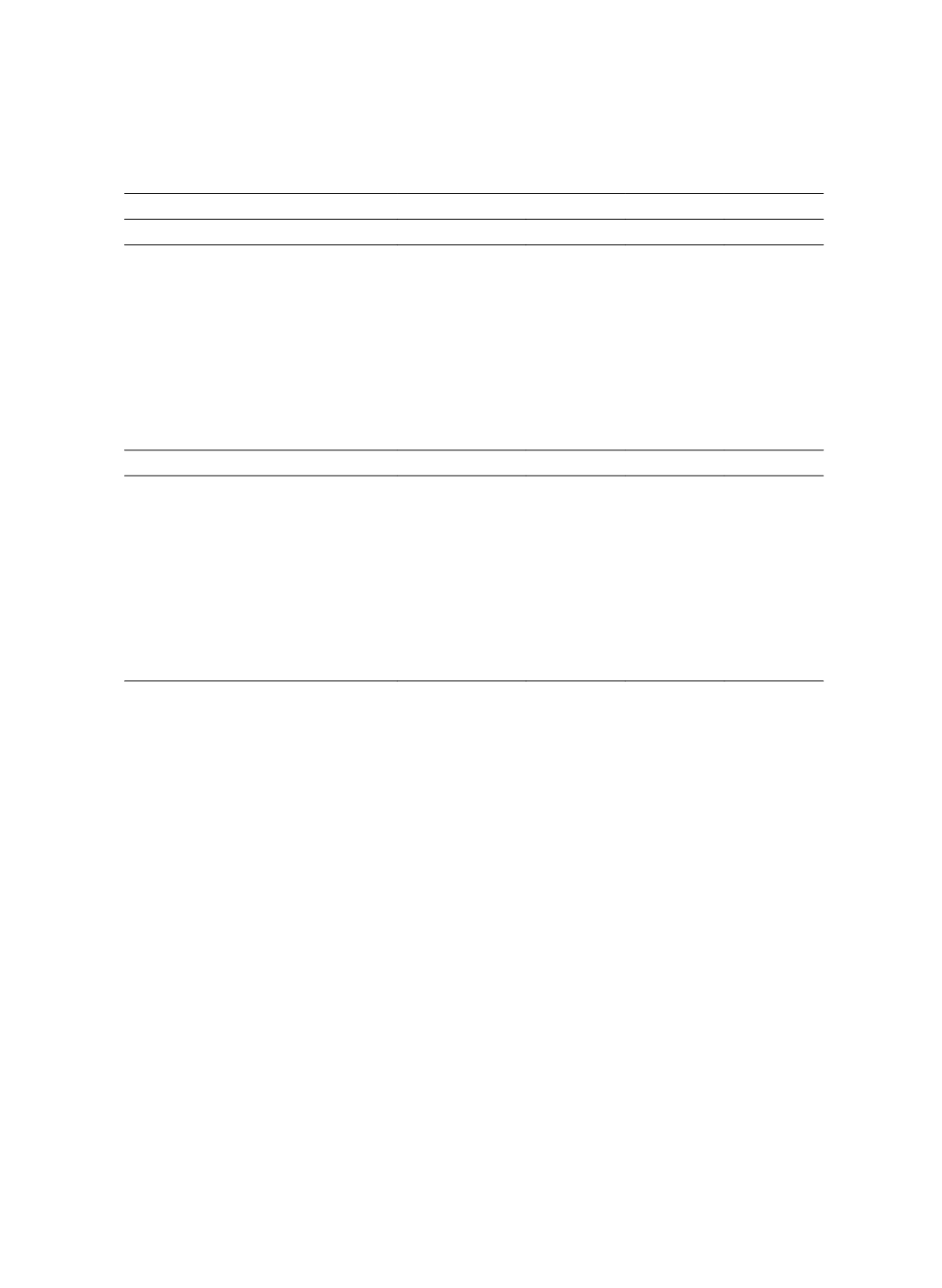

Table 4 Percentage of the Response Types in SE and JE Modes in Studies 3 and 4

Accu.

a

Over

b

Under

c

Study 3

Certainty-positive (Happiness)

0-ending

65

30

5

9-ending

30

55

15

Certainty-negative (Disgust)

0-ending

70

15

15

9-ending

45

35

20

Uncertainty-positive (Hopefulness)

0-ending

65

20

15

9-ending

40

40

20

Uncertainty-negative (Fear)

0-ending

75

5

20

9-ending

25

5

70

Study 4

Separate-positive

0-ending

70

20

10

9-ending

35

55

10

Separate-negative

0-ending

70

20

10

9-ending

40

5

55

Joint-positive

0-ending

75

20

5

9-ending

65

30

5

Joint-negative

0-ending

75

10

15

9-ending

70

5

25

a Accu.: The percentage of accurate group

b Over.: The percentage of overestimated group

c Under.: The percentage of underestimated group

Discussion

Study 3 demonstrated that differences in quantitative estimates made by people

experiencing a high level of processing fluency induced by certainty in their emotions and

those made by people with a low level of processing fluency induced by uncertainty in

their emotions are greater when people experience positive emotions than when they

experience negative emotions. These results helped clarify the role of incidental emotion

and demonstrated the mediating influence of processing fluency on the nine-ending price

effect. Nevertheless, further analysis was required in Study 4 to answer the second

question referred to above.

3.4 Study 4

Study 3 differentiated between the influences of emotional certainty and emotional

uncertainty on the nine-ending price effect. The findings helped clarify that not all positive