239

臺大管理論叢

第

28

卷第

1

期

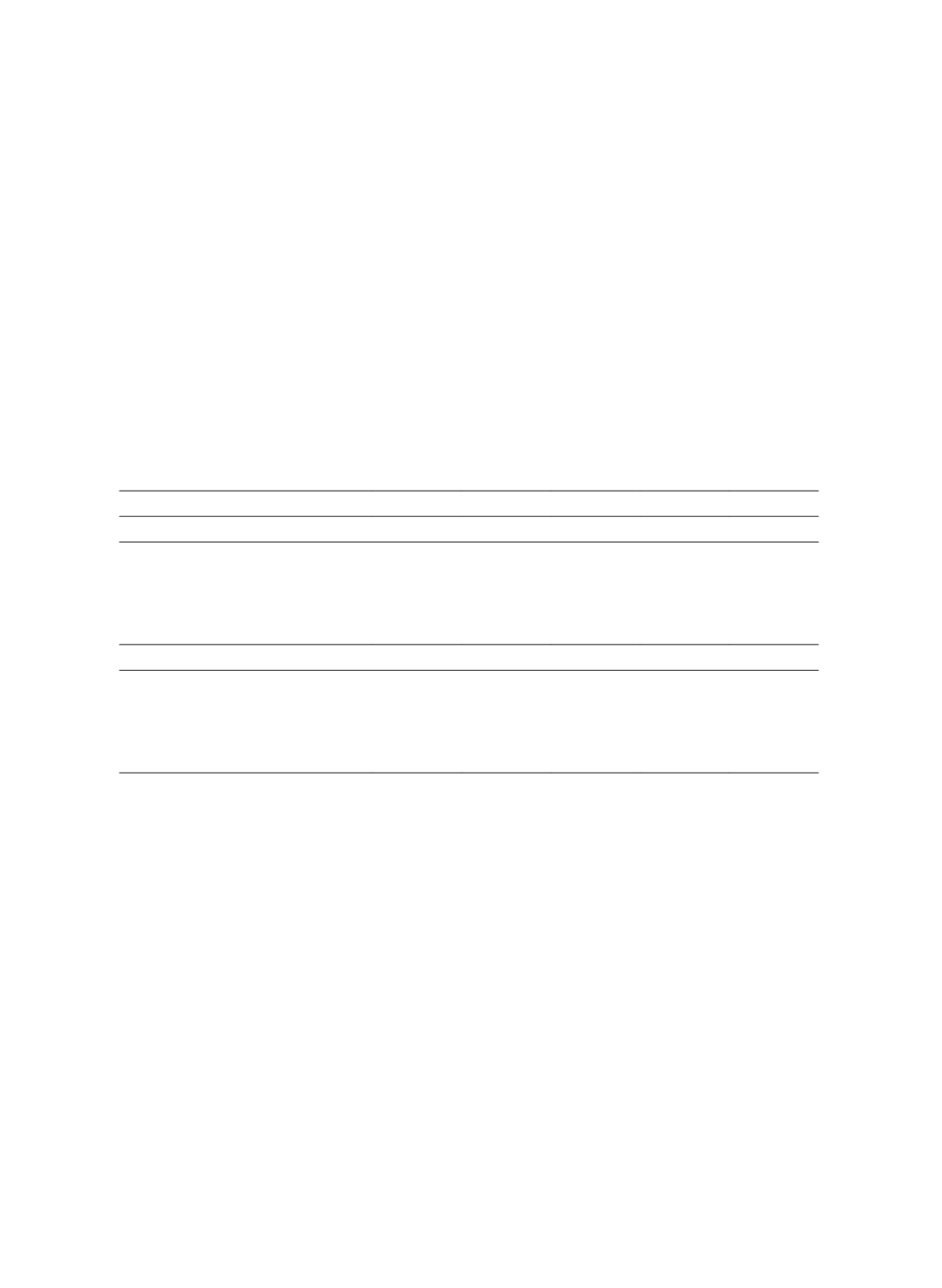

As predicted, the results shown in Table 3 demonstrated that the effects of certainty

appraisals of incidental emotions on differences in quantitative estimates were significant

(

F

(1,152) = 14.76,

p

< .01). The results also showed that a nine-ending price triggered

greater differences in purchase quantity estimates than did a zero-ending price among

people appraised as being certain of their incidental emotions (

M

Diff-Happiness

= 2.93,

M

Diff-Disgust

= .88,

F

(1,86) = 26.35,

p

< .01). In contrast, there was no difference in purchase quantity

estimates made by those uncertain of their incidental emotional state between nine-ending

and zero-ending prices (

M

Diff-Hopefulness

= .40,

M

Diff-Fear

= .05,

F

(1, 86) = 2.33,

p

> .01). That is,

the foregoing results all provided support for H3.

Table 3 Quantitative Estimations in Studies 3 and 4

9-ending 0-ending difference F value P value

Study 3

Certainty-positive (Happiness)

47.85

44.92

2.93

Certainty-negative (Disgust)

45.68

44.80

0.88

14.76

<.01

Uncertainty-positive (Hopefulness)

45.02

44.62

0.40

Uncertainty- negative (Fear)

44.70

44.65

0.05

Study 4

Separate-positive

47.22

44.97

2.25

Separate-negative

45.51

44.71

0.80

4.33

<.05

Joint-positive

44.96

44.51

0.45

Joint-negative

44.67

44.59

0.08

To examine the results of the analyses in more depth, the quantitative estimates were

also classified according to their consistency with the nine-ending pricing effect by

calculating the percentage of participants choosing nine-ending and zero-ending prices

among each group, as shown in Table 4. The results demonstrated an interaction among

certainty appraisals, overestimates and underestimates, and nine- and zero-ending prices

(χ

2

(1) = 6.23,

p

< 0.05). In addition, the result whereby a nine-ending price may trigger a

greater percentage of overestimates than that triggered by a zero-ending price among

people appraised as being certain of their incidental emotions was close to being

marginally significant (χ

2

(1) = 2.58,

p

= .108). In contrast, the results provided significant

evidence that a nine-ending price triggers a greater percentage of underestimates than a

zero-ending price among people uncertain of their emotions (χ

2

(1) = 4.09,

p

< .05). Taken

together, the results provided support for my inference.