235

臺大管理論叢

第

28

卷第

1

期

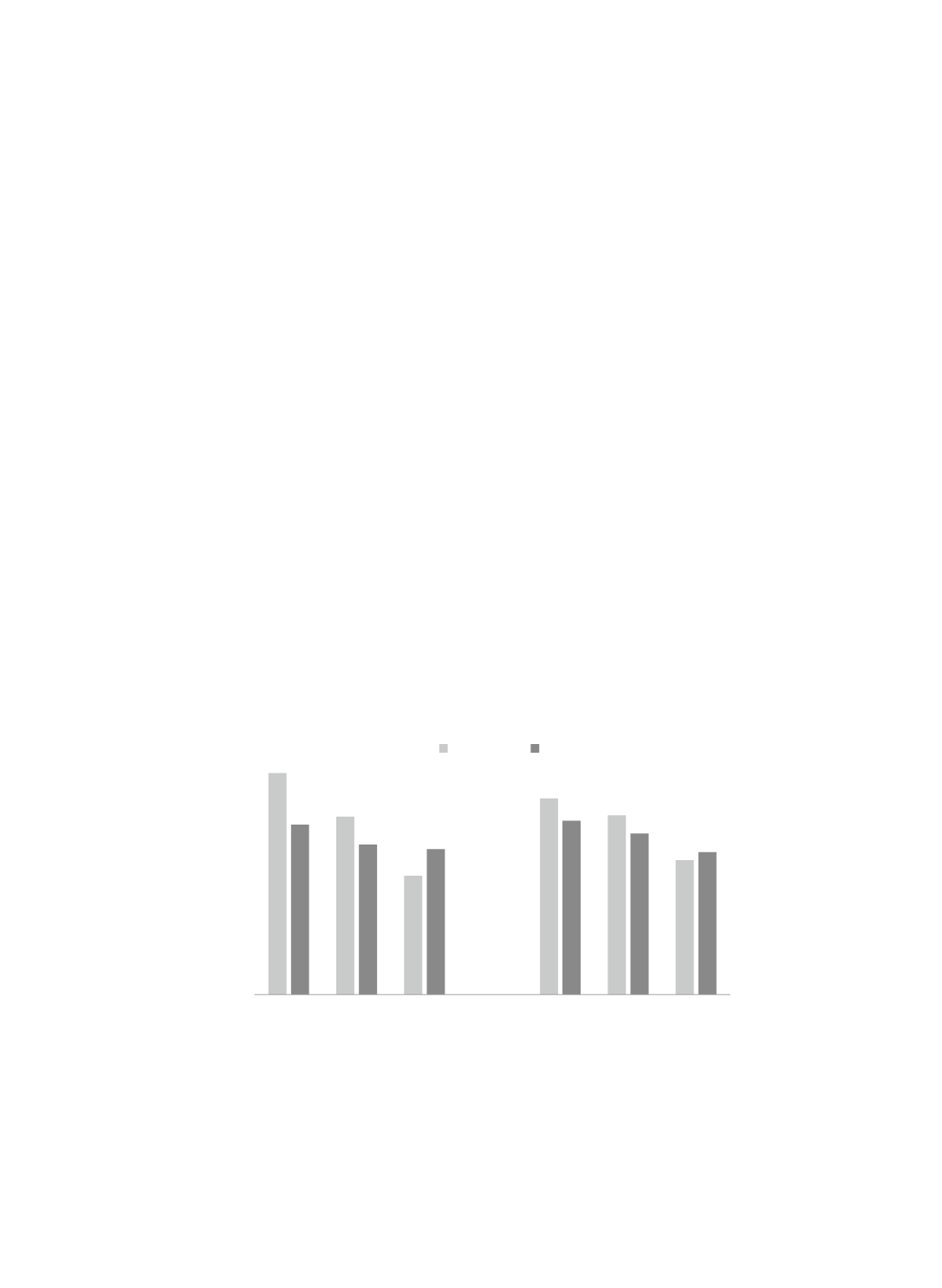

As shown in Table 2 and Figure 1, a three-way ANOVA showed a significant

interaction among the nine-ending price, emotion, and processing fluency (

F

(2,228) =

38.61,

p

< .01). To clarify the direction of the results, further planned paired contrasts on

the nine-ending price revealed a significant interaction effect among positive, neutral and

negative emotions for participants whose emotions were manipulated to induce a high

level of processing fluency (

F

(2, 117) = 18.77,

p

< .01). The nine-ending price had a

greater effect (

M

= 5.49, SD = .78) on purchase intention than that exerted by the zero-

ending price (

M

= 4.21, SD = .63) (

t

= 6.65,

p

< .01) for participants in the positive

emotional condition, with similar results also being derived for those in the neutral

emotional condition (

M

= 4.41, SD = 1.03 versus

M

= 3.72, SD = .89, respectively;

t

=

3.19,

p

< .01). In contrast, the negative emotion induction resulted in the nine-ending price

having less of an effect (

M

= 2.95, SD = .70) on purchase intention than the zero-ending

price (

M

= 3.61, SD= .88) (

t

= 2.42,

p

< .05). However, the analysis indicated an

insignificant pattern for those induced to experience a low level of processing fluency

(

F

(2, 117) = 2.11,

p

> 0.1). These results all provided support for the prediction that

processing fluency mediates the relation between incidental emotion and the nine-ending

price effect.

5.49

4.41

2.95

4.86

4.44

3.33

4.21

3.72 3.61

4.31

3.99

3.53

9-ending 0-ending

no-fluency-positive

no-fluency-neutral

no-fluency-negative

fluency-positive

fluency-neutral

fluency-negative

Figure 1 The Results of Study 2