公司盈餘平穩化行為與盈餘資訊性之關係-合格境外機構投資者角色之檢測

16

0.501 (0.500) to reflect the fractional ranking of the correlation coefficient (between 0 and

1). The mean (median) QFIIs’ ownership (QFII%) is 7.486% (2.506%), which is

approximately the same as the mean QFIIs’ ownership of all listed firms (i.e., 7.027%). This

result suggests that the QFIIs’ ownership is relatively small and QFIIs focus on some

internationally visible listed firms in Taiwan. Since the standard deviation of our empirical

variables is somewhat large, this study adopts White’s (1980) heteroskedasticity consistent

covariance matrix estimator to correct estimates of the coefficient covariances in the possible

presence of heteroskedasticity in all empirical regressions.

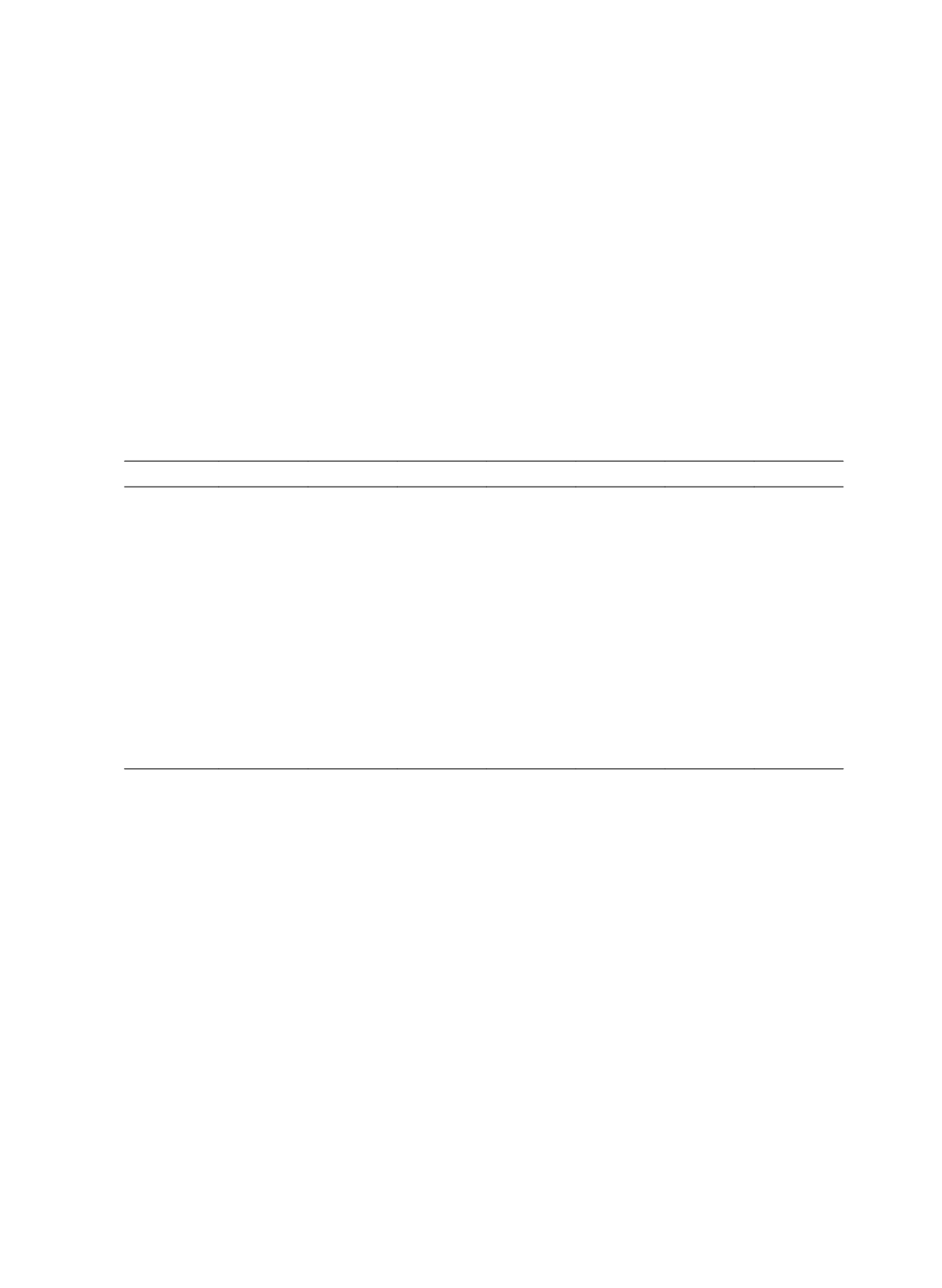

Table 2 Descriptive Statistics of Related Variables (N = 5,766)

Variables

Mean

SD

Min

Q1

Med.

Q3

Max

R

t

0.050

0.174

-0.546

-0.044

0.027

0.113

1.555

X

t-1

-0.027

0.432 -13.280

0.007

0.048

0.082

1.860

X

t

0.002

0.330

-6.606

0.004

0.045

0.091

4.444

X

t3

0.048

0.798 -27.226

-0.037

0.104

0.257

3.480

R

t3

0.196

0.310

-0.761

0.016

0.146

0.313

3.968

IS

t

0.501

0.287

0.001

0.253

0.500

0.748

1.000

QFII%

t

7.486 11.524

0.000

0.380

2.506

8.875 73.956

QFII(CV)

t

0.494

0.648

0.000

0.077

0.246

0.649

3.464

LEV

t

0.395

0.166

0.016

0.272

0.393

0.502

0.972

MB

t

1.658

1.535

0.070

0.820

1.240

1.960 31.800

SIZE

t

8.181

1.478

4.205

7.123

8.033

9.006 14.371

Legends:

1. R

t

: a firm’s ex-dividend annual stock return in year

t

. X

t-1

: the earnings per share in year

t

-1, deflated

by the stock price at the beginning of year

t

. X

t

: the earnings per share in year

t

, deflated by the

stock price at the beginning of year

t

. X

t3

: the sum of earnings per share for year

t

+1 thuough

t

+3,

deflated by the stock price at the beginning of year

t

. R

t3

: the annually compounded monthly returns

for year

t

+1 thuough

t

+3. IS

t

: income smoothing measure. QFII%

t

: the percentage of qualified foreign

institutional shareholdings. QFII(CV)

t

: the coefficient of variation of shareholdings. LEV

t

: firm’s

leverage. MB

t

: market-to-book ratio. SIZE

t

: natural logarithm of market value of common equity in

year

t

.

2. “a” and “b” denote the significance on 1% and 5% levels respectively, based on two-tailed tests.

Table 3 presents the correlations between related variables. It reveals that QFIIs’

ownership are significantly positive-associated with past, current, and future earnings. This

result suggests that firms with high QFIIs ownership have better earnings performance. It is

surprising to find that the correlation between the annual stock returns (R

t

) and the income