公司盈餘平穩化行為與盈餘資訊性之關係-合格境外機構投資者角色之檢測

22

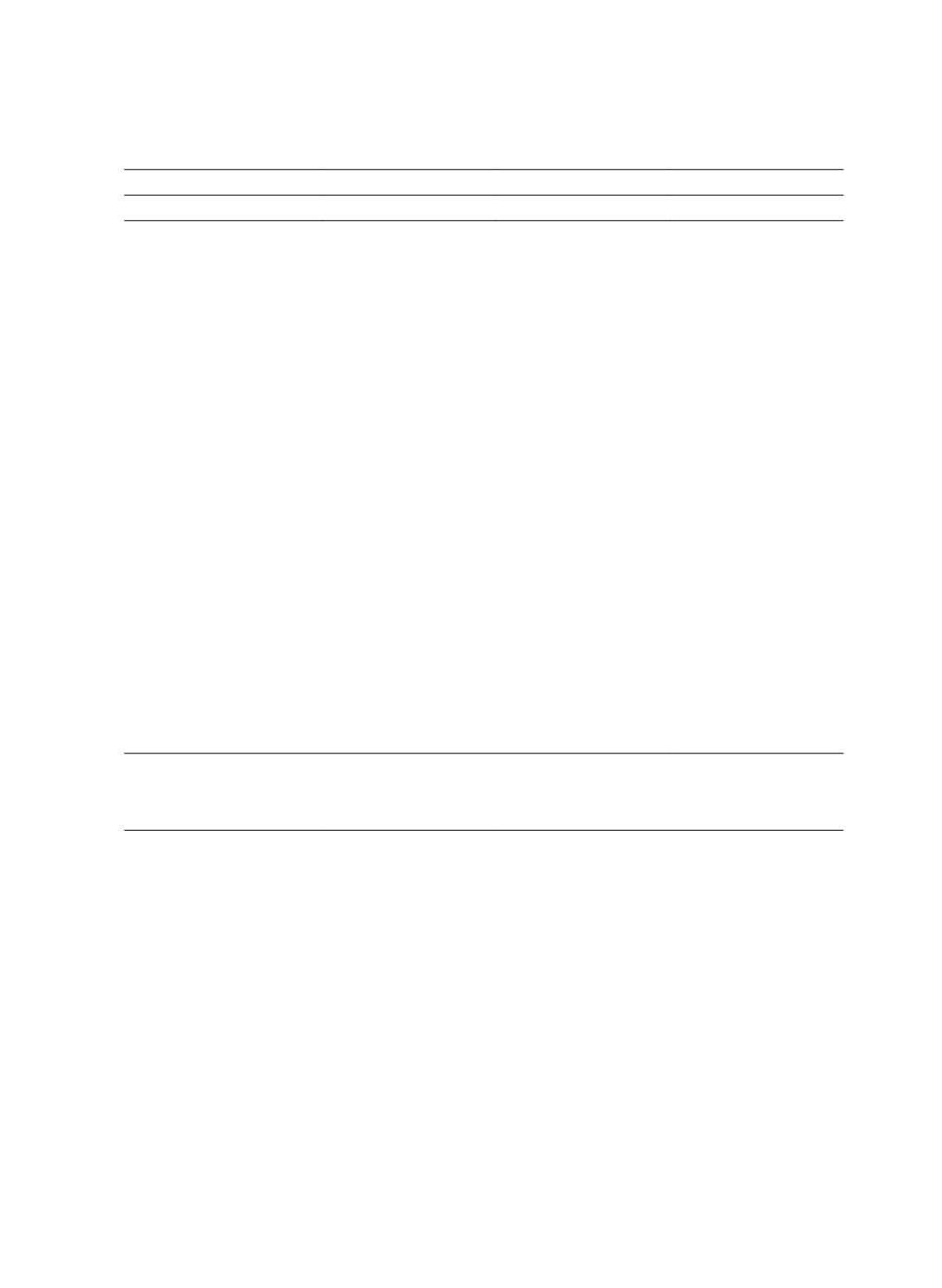

Model

IS

IS_QFII

IS_HH_HL

Variables

β

(t-value)

β

(t-value)

β

(t-value)

QFII_HH

t

---

---

-0.027

(-1.53)

QFII_HL

t

---

---

-0.015

(-0.80)

QFII_HH

t

*IS

t

---

---

-0.020

(-0.79)

QFII_HL

t

*IS

t

---

---

-0.024

(-1.19)

QFII_HH

t

*X

t3

---

---

0.052

b

(2.04)

QFII_HL

t

*X

t3

---

---

0.066

(1.57)

QFII_HH

t

*IS

t

*X

t3

---

---

-0.055

(-1.47)

QFII_HL

t

*IS

t

*X

t3

---

---

-0.075

(-1.45)

LEV

t

0.086

a

(2.72)

0.091

a

(2.81)

0.090

a

(2.77)

MB

t

0.018

b

(2.38)

0.018

a

(2.65)

0.017

b

(2.27)

SIZE

t

0.005

(0.26)

0.007

(0.38)

0.008

(0.42)

N

5,766

5,766

5,766

Adj_

R

2

33.14%

33.37%

33.55%

F_value

3.58

a

3.60

a

3.61

a

Legends:

1. R

t

: a firm’s ex-dividend annual stock return in year

t

. X

t-1

: the earnings per share in year

t

-1, deflated

by the stock price at the beginning of year

t

. X

t

: the earnings per share in year

t

, deflated by the

stock price at the beginning of year

t

. X

t3

: the sum of earnings per share for year

t

+1 thuough

t

+3,

deflated by the stock price at the beginning of year t. R

t3

: a firm’s sum of annual stock returns for

year

t

+1 thuough

t

+3. IS

t

: income smoothing measure. QFII

t

: the percentage of qualified foreign

institutional shareholdings. QFII_HH

t

: dummy variable (1 if the firm with high qualified foreign

institutional shareholdings and high qualified foreign institutional shareholdings volatility, 0

otherwise). QFII_HL

t

: dummy variable (1 if firms with high qualified foreign institutional

shareholdings and low qualified foreign institutional shareholdings volatility, 0 otherwise). LEV

t

: firm’s

leverage. MB

t

: market-to-book ratio in year

t

. SIZE

t

: natural logarithm of market value of common

equity in year

t

.

2. “a” and “b” denote the significance on 1% and 5% levels respectively, based on two-tailed tests.