19

臺大管理論叢

第

27

卷第

4

期

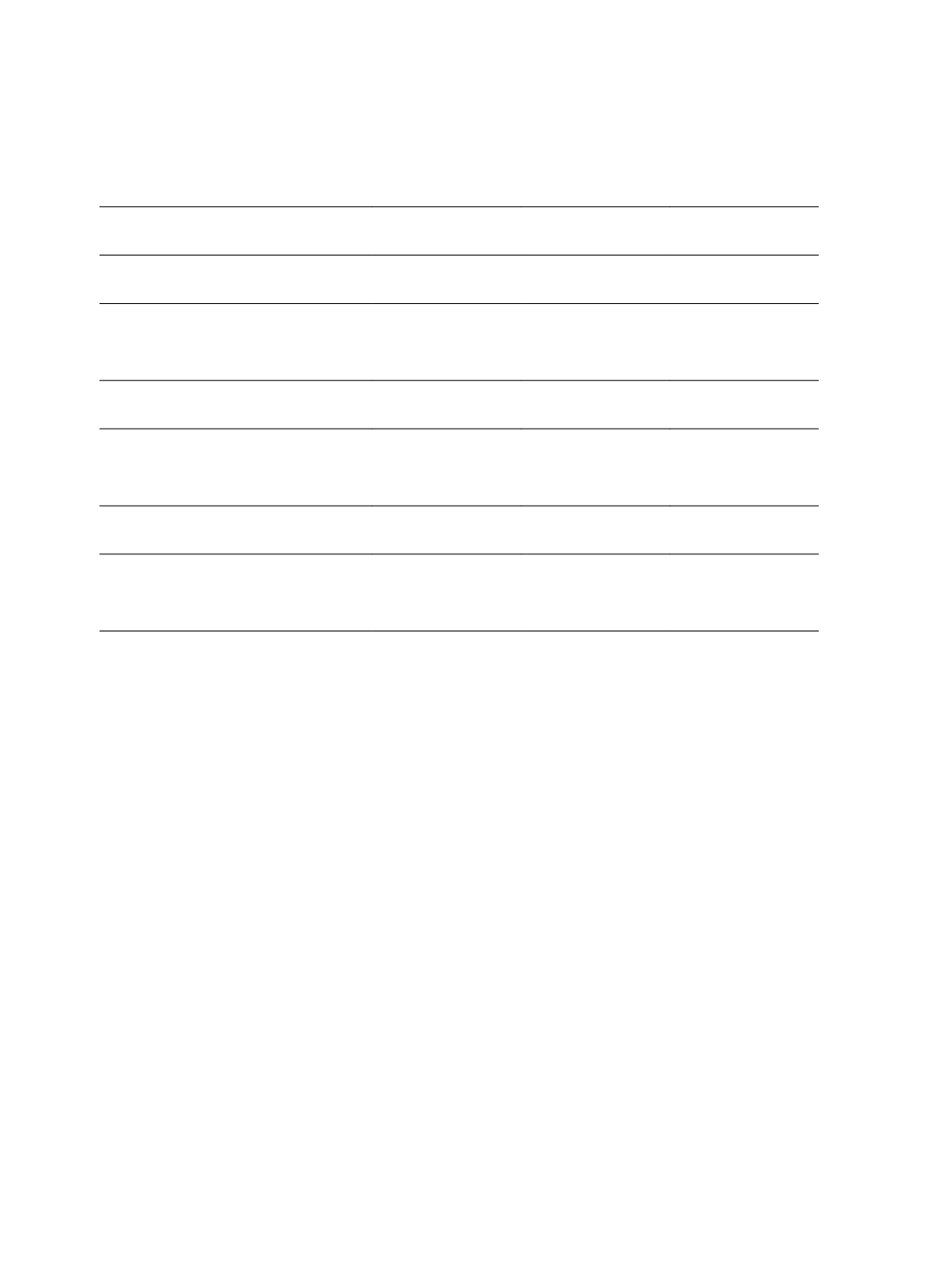

Table 4 Results of the Role of QFIIs in Earnings Informativeness of Income

Smoothing-Zero Cost Portfolio Return Examinations

X

t3

_1 (low X

t3

)

(n = 1,922)

X

t3

_2 (middle X

t3

)

(n = 1,922)

X

t3

_3 (high X

t3

)

(n = 1,922)

Panel A: Return Difference for High Income Smoothing/High QFII Group (9) and High Income

Smoothing/Low QFII Group (7)

H_IS_H_QFII return (9)

0.0325

0.0258

0.0608

H_IS_L_QFII return (7)

0.0796

0.0495

0.0777

Zero-cost-portfolio return (9-7)

-0.0471***

-0.0247*

-0.0169

Panel B: Return Difference for High Income Smoothing/High QFII Group (9) and Low Income

Smoothing/Low QFII Group (1)

H_IS_H_QFII return (9)

0.0325

0.0258

0.0608

L_IS_L_QFII return (1)

0.0619

0.0286

0.0859

Zero-cost-portfolio return (9-1)

-0.0294*

-0.0028

-0.0251**

Panel C: Return Difference for High Income Smoothing/High QFII Group (9) and Low Income

Smoothing/High QFII Group (3)

H_IS_H_QFII return (9)

0.0325

0.0258

0.0608

L_IS_H_QFII return (3)

0.0616

0.0259

0.0645

Zero-cost-portfolio return (9-3)

-0.0291*

-0.0001

-0.0037

Legends:

1. The portfolio is carried out by a two-way sequential sorting. Firstly, the firms are sorted into three

groups based on earnings (X

t3

), which is denoted as low X

t3

, middle X

t3

, and high X

t3

groups,

respectively. Secondly, within each tercile, first sort income smoothing, then sequentially sort on

QFIIs’ participation level. This procedure results nine subsamples (3*3) from the low income

smoothing with low QFII ownership to the high income smoothing with high QFII ownership in each

earnings tercile.

2. “***”, “**”, and “*” denote the significance on 1%, 5%, and 10% levels respectively, based on one-

tailed tests.

4.3 Regression Results

The estimation process of this study begins with least-squares regression of the pooled

data followed by an assessment of the validity of the pooled model’s assumption of a single,

overall intercept term. The Lagrange Multiplier Statistic (LM test) rejects the pooled model

(which implies heterogeneous intercepts), thus panel data models, as conjectured, offer a

more powerful approach. Subsequently, the estimation proceeds to panel data analysis and a

choice between the fixed effect and random effect. The Hausman specification test

(Hausman, 1978) reveals the potential for omitted variables bias and the importance of firm-

specific effects in this setting (

x

2

= 631.47 in IS model,

x

2

= 649.60 in IS_QFII model, and

x

2

= 660.57 in IS_HH_HL model), thus we anticipate the need to use the fixed-effect approach