Page 123 - 34-1

P. 123

NTU Management Review Vol. 34 No. 1 Apr. 2024

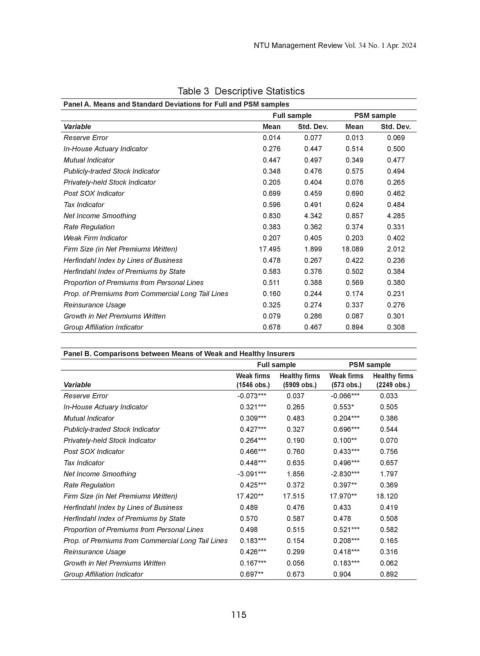

Table 3 Descriptive Statistics

Panel A. Means and Standard Deviations for Full and PSM samples

Full sample PSM sample

Variable Mean Std. Dev. Mean Std. Dev.

Reserve Error 0.014 0.077 0.013 0.069

In-House Actuary Indicator 0.276 0.447 0.514 0.500

Mutual Indicator 0.447 0.497 0.349 0.477

Publicly-traded Stock Indicator 0.348 0.476 0.575 0.494

Privately-held Stock Indicator 0.205 0.404 0.076 0.265

Post SOX Indicator 0.699 0.459 0.690 0.462

Tax Indicator 0.596 0.491 0.624 0.484

Net Income Smoothing 0.830 4.342 0.857 4.285

Rate Regulation 0.383 0.362 0.374 0.331

Weak Firm Indicator 0.207 0.405 0.203 0.402

Firm Size (in Net Premiums Written) 17.495 1.899 18.089 2.012

Herfindahl Index by Lines of Business 0.478 0.267 0.422 0.236

Herfindahl Index of Premiums by State 0.583 0.376 0.502 0.384

Proportion of Premiums from Personal Lines 0.511 0.388 0.569 0.380

Prop. of Premiums from Commercial Long Tail Lines 0.160 0.244 0.174 0.231

Reinsurance Usage 0.325 0.274 0.337 0.276

Growth in Net Premiums Written 0.079 0.286 0.087 0.301

Group Affiliation Indicator 0.678 0.467 0.894 0.308

Panel B. Comparisons between Means of Weak and Healthy Insurers

Full sample PSM sample

Weak firms Healthy firms Weak firms Healthy firms

Variable (1546 obs.) (5909 obs.) (573 obs.) (2249 obs.)

Reserve Error -0.073*** 0.037 -0.066*** 0.033

In-House Actuary Indicator 0.321*** 0.265 0.553* 0.505

Mutual Indicator 0.309*** 0.483 0.204*** 0.386

Publicly-traded Stock Indicator 0.427*** 0.327 0.696*** 0.544

Privately-held Stock Indicator 0.264*** 0.190 0.100** 0.070

Post SOX Indicator 0.466*** 0.760 0.433*** 0.756

Tax Indicator 0.448*** 0.635 0.496*** 0.657

Net Income Smoothing -3.091*** 1.856 -2.830*** 1.797

Rate Regulation 0.425*** 0.372 0.397** 0.369

Firm Size (in Net Premiums Written) 17.420** 17.515 17.970** 18.120

Herfindahl Index by Lines of Business 0.489 0.476 0.433 0.419

Herfindahl Index of Premiums by State 0.570 0.587 0.478 0.508

Proportion of Premiums from Personal Lines 0.498 0.515 0.521*** 0.582

Prop. of Premiums from Commercial Long Tail Lines 0.183*** 0.154 0.208*** 0.165

Reinsurance Usage 0.426*** 0.299 0.418*** 0.316

Growth in Net Premiums Written 0.167*** 0.056 0.183*** 0.062

Group Affiliation Indicator 0.697** 0.673 0.904 0.892

115