投資機會和投資者保護機制對控股股東派息的影響

202

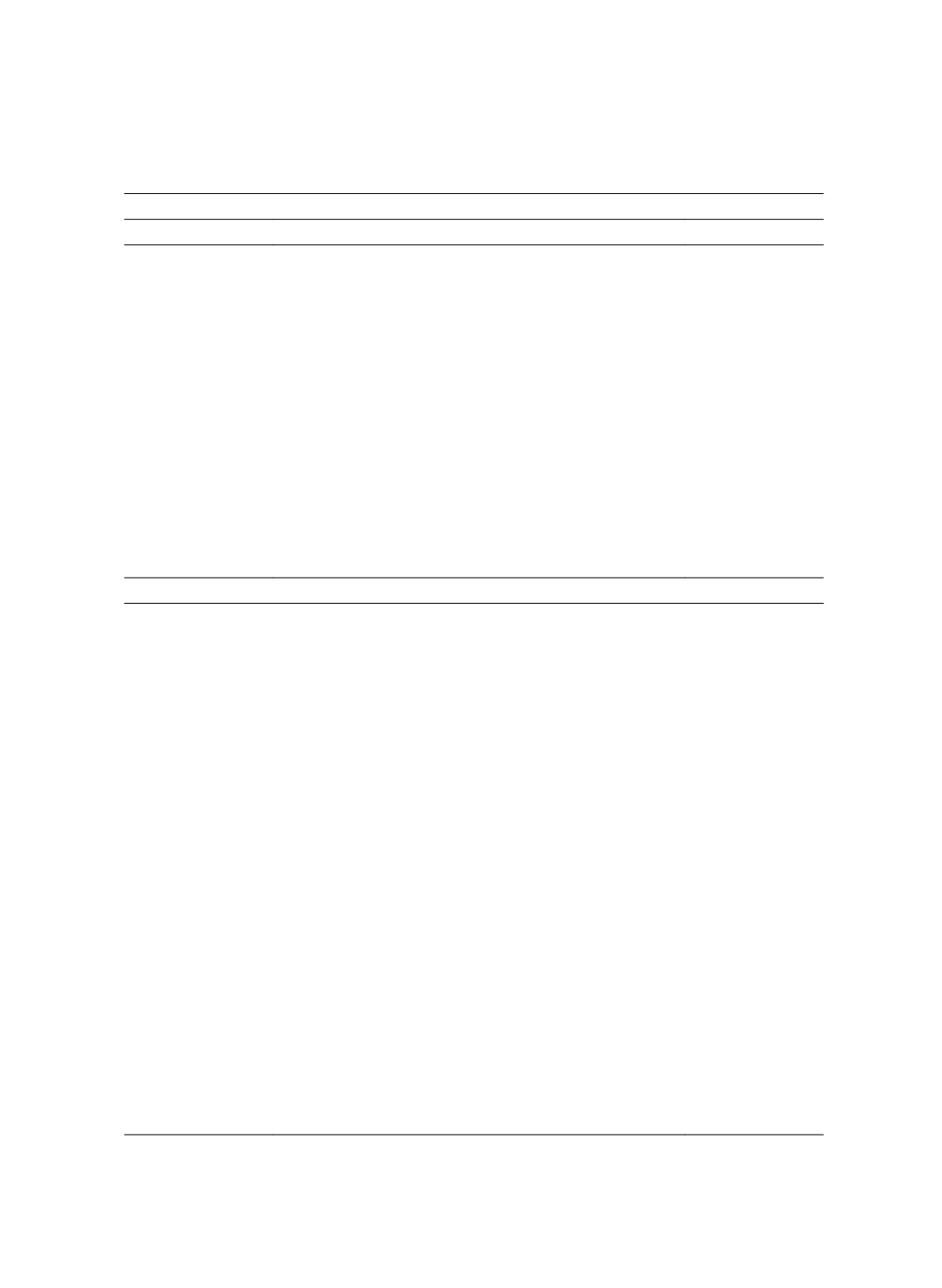

Panel B Definitions and Sources of the Variables

Variable

Definition

Source

Dividend Payout Ratios:

Dividends/Sales

(

Dvd/Sales

)

Total cash dividends paid to common and preferred

shareholders divided by net sales.

WorldScope

Dividends/

Operating cash

flows (

Dvd/CFO

)

Total cash dividends paid to common and preferred

shareholders divided by the total funds from operations.

WorldScope

Dividends/MV

(

Dvd/MV

)

Total cash dividends paid to common and preferred

shareholders divided by the market value of equity at the

end of the year.

WorldScope

Dividends/Earnings

(

Dvd/E

)

Total cash dividends paid to common and preferred

shareholders divided by earnings after tax and interest

but before extraordinary items.

WorldScope

Industry-adjusted

Dividend Payout

Ratios (

IADvd

)

The difference between the dividend payout ratio and the

industry (worldwide) median dividend payout ratio. The

2-digit primary SIC is used to define the industry.

WorldScope

Legal Institutions:

Legal Tradition

(

Legal

)

The legal tradition of the country in which the firm is

domiciled, which equals one if it is English common law

and zero otherwise.

La Porta et al.

(1998)

Anti-director Rights

(

Right

)

Index of minority shareholder protections, which is

formed by “adding 1 when: (1) the country allows

shareholders to mail their proxy votes; (2) shareholders

are not required to deposit their shares prior to the

General Shareholders’ meeting; (3) cumulative voting or

proportional representation of minorities on the board of

directors is allowed; (4) an oppressed minorities

mechanism is in place; (5) the minimum percentage of

share capital that entitles a shareholder to call for an

Extraordinary Shareholders’ meeting is less than or equal

to 10% (the sample median); (6) or when shareholders

have preemptive rights that can only be waved by a

shareholders’ meeting. The range for the index is from 0

to 6.”

La Porta et al.

(1998)

“Company laws or

commercial code”

Disclosure Rating

(

Disclosure

)

The rating of disclosure standards based on

“measurement of the inclusion or omission of 90 items in

the annual report.” The index was created by examining

and rating the 1990 annual reports of firms on their

inclusion or omission of 90 items.

La Porta et al.

(1998)

“Center for

International

Financial Analysis

and Research”