27

臺大管理論叢

第

27

卷第

4

期

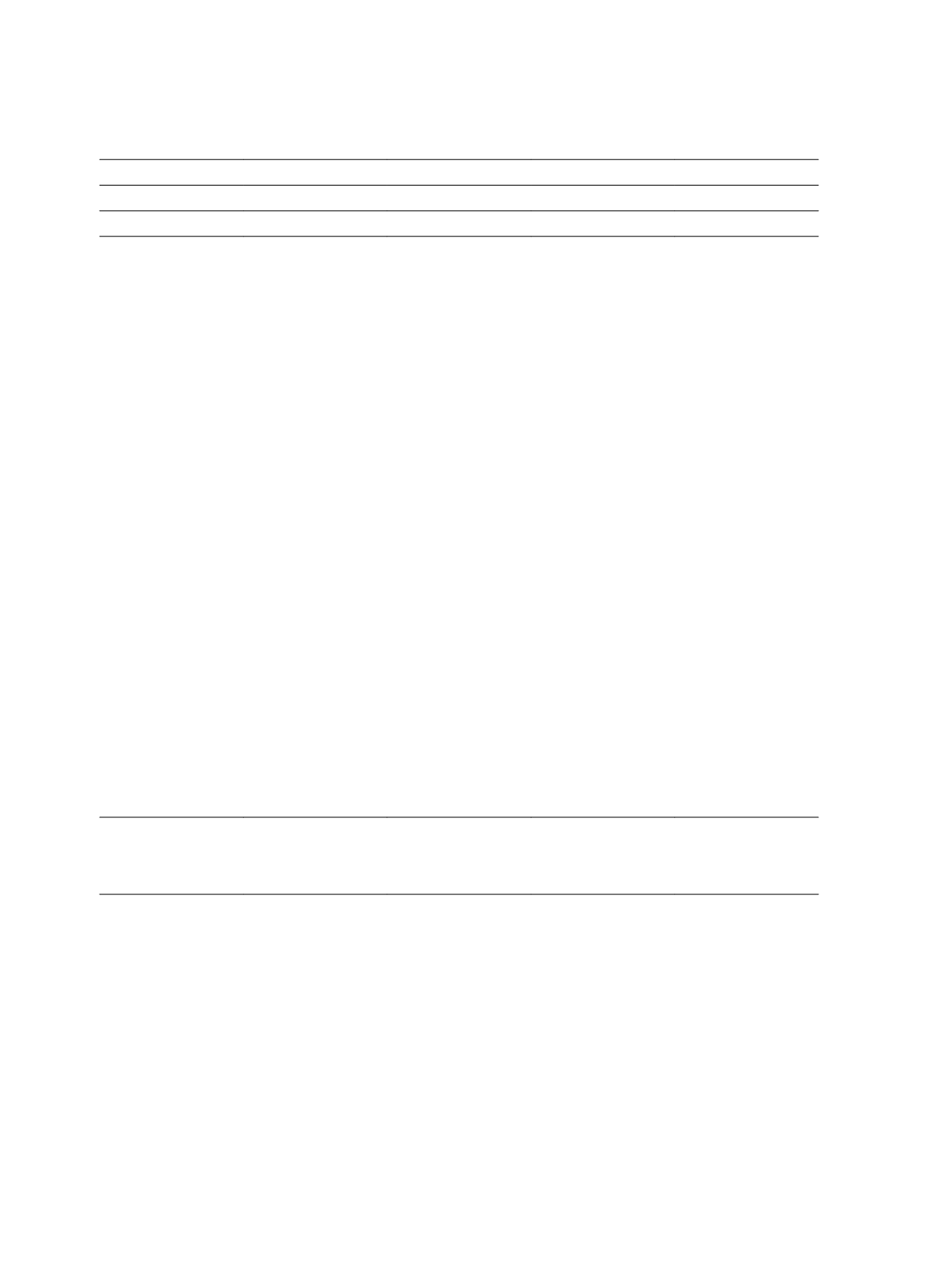

Pre-deregulation

Post-deregulation

Model

IS_QFII

IS_HH_HL

IS_QFII

IS_HH_HL

Variables

β

(t-value)

β

(t-value)

β

(t-value)

β

(t-value)

QFII

t

*IS

t

*X

t3

-0.002

(-0.60)

---

-0.005

b

(-2.12)

---

QFII_HH

t

---

-0.060

b

(-1.98)

---

-0.005

(-0.32)

QFII_HL

t

---

-0.041

(-1.11)

---

0.034

a

(2.98)

QFII_HH

t

*IS

t

---

0.054

a

(3.96)

---

-0.038

(-1.29)

QFII_HL

t

*IS

t

---

0.033

(0.93)

---

-0.071

b

(-2.55)

QFII_HH

t

*X

t3

---

-0.012

(-0.18)

---

0.087

a

(4.07)

QFII_HL

t

*X

t3

---

0.081

a

(3.40)

---

0.032

(1.07)

QFII_HH

t

*IS

t

*X

t3

---

0.011

(0.10)

---

-0.128

a

(-4.30)

QFII_HL

t

*IS

t

*X

t3

---

-0.124

b

(-1.98)

---

-0.063

(-1.20)

LEV

t

0.080

(1.44)

0.083

(1.50)

0.129

a

(5.21)

0.126

a

(4.45)

MB

t

0.033

a

(3.44)

0.033

a

(3.38)

0.006

c

(1.87)

0.006

(1.36)

SIZE

t

0.005

(0.19)

0.007

(0.27)

0.024

b

(1.99)

0.025

c

(1.92)

N

2,170

2,170

3,596

3,596

Adj_

R

2

48.82%

48.92%

28.55%

28.70%

F_value

4.50

a

4.49

a

2.37

a

2.37

a

Legends:

1. R

t

: a firm’s ex-dividend annual stock return in year

t

. X

t-1

: the earnings per share in year

t

-1, deflated

by the stock price at the beginning of year

t

. X

t

: the earnings per share in year

t

, deflated by the

stock price at the beginning of year

t

. X

t3

: the sum of earnings per share for year

t

+1 through

t

+3,

deflated by the stock price at the beginning of year

t

. R

t3

: a firm’s sum of annual stock returns for

year

t

+1 through

t

+3. IS

t

: income smoothing measure. QFII

t

: the percentage of qualified foreign

institutional shareholdings. QFII_HH

t

: dummy variable (1 if the firm with high qualified foreign

institutional shareholdings and high qualified foreign institutional shareholdings volatility, 0

otherwise). QFII_HL

t

: dummy variable (1 if firms with high qualified foreign institutional

shareholdings and low qualified foreign institutional shareholdings volatility, 0 otherwise). LEV

t

: firm’s

leverage. MB

t

: market-to-book ratio in year

t

. SIZE

t

: natural logarithm of market value of common

equity in year

t

.

2. “a” and “b” denote the significance on 1% and 5% levels respectively, based on two-tailed tests.