29

臺大管理論叢

第

27

卷第

4

期

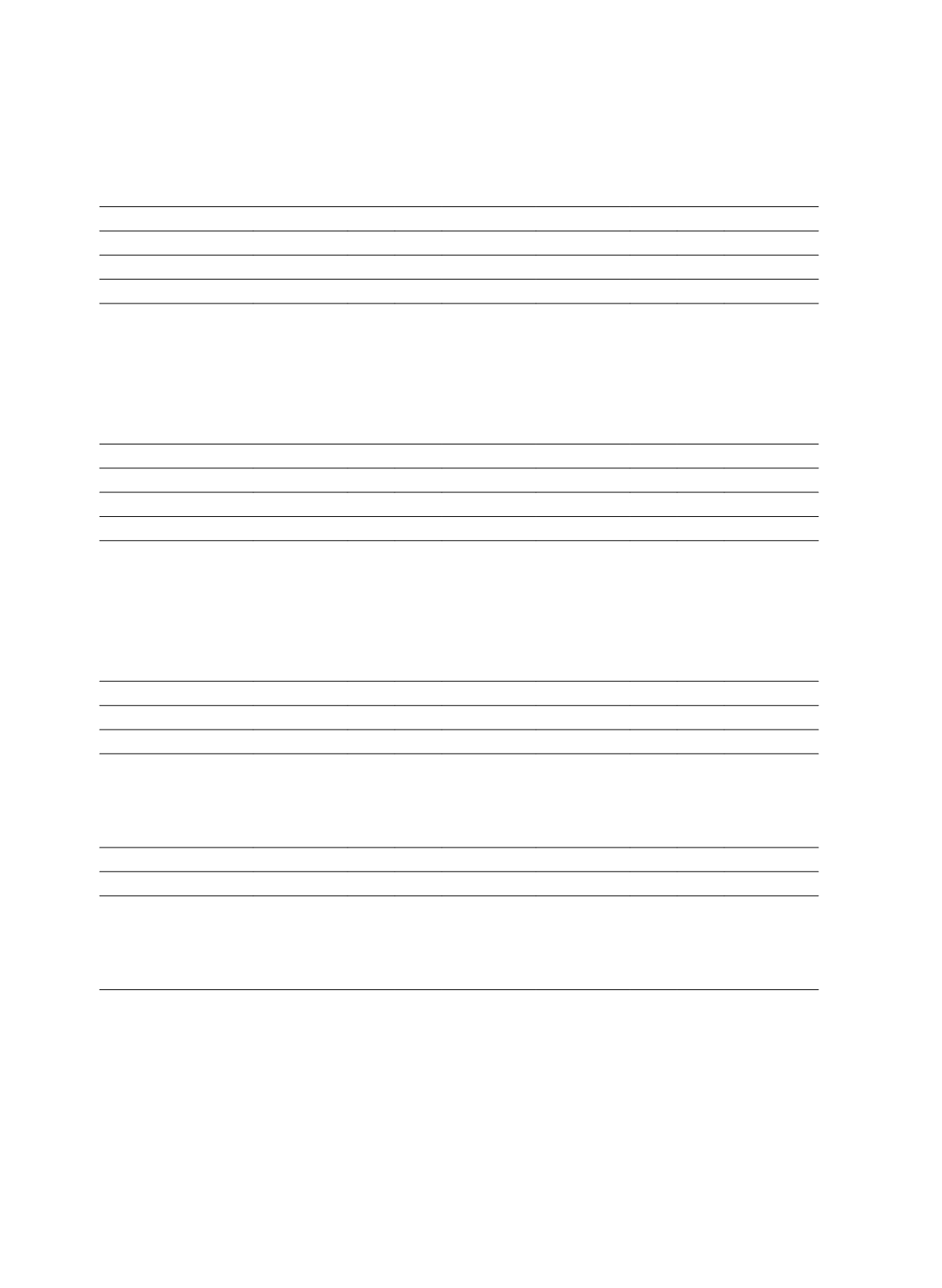

Table 7 Results of the Role of QFIIs in Earnings Informativeness of Income

Smoothing-Robustness Tests

Panel A: Using Variance Ratio to Measure Income Smoothing

Pre-deregulation

Post-deregulation

Model

VR_QFII

VR_HH_HL

VR_QFII

VR_HH_HL

Variables

β

(

t

-value)

β

(

t

-value)

β

(

t

-value)

β

(

t

-value)

QFII

t

*VR

t

*X

t3

0.005

(0.58)

---

-0.005

c

(-1.82)

---

QFII_HH

t

*VR

t

*X

t3

---

-0.014

(-0.12)

---

-0.038

(-0.83)

QFII_HL

t

*VR

t

*X

t3

---

-0.091

(-0.93)

---

-0.092

b

(-2.09)

Panel B: Alternative Influential Cutoff Point of QFII Examinations

Pre-deregulation

Post-deregulation

Model

IS_QFII

IS_QFII

IS_HH_HL IS_QFII

IS_QFII

IS_HH_HL

Cutoff rate

5% Median Median

5% Median Median

QFII

t

*IS

t

*X

t3

-0.090

(-1.44)

0.041

(0.53)

---

-0.074

c

(-1.72)

-0.109

a

(-3.07)

---

QFII_HH

t

*IS

t

*X

t3

---

---

-0.007

(-0.26)

---

---

-0.142

a

(-6.31)

QFII_HL

t

*IS

t

*X

t3

---

---

-0.007

(-0.13)

---

---

-0.106

b

(-2.06)

Panel C: Using Shareholdings Turnover to Proxy QFIIs Volatility

Pre-deregulation

Post-deregulation

Cutoff criteria

5%

Median

5%

Median

QFII_HH

t

*IS

t

*X

t3

-0.008

(-0.07)

0.112

(1.24)

-0.083

c

(-1.81)

-0.134

a

(-3.37)

QFII_HL

t

*IS

t

*X

t3

0.052

b

(2.21)

0.123

(1.34)

-0.067

(-1.59)

-0.102

a

(-2.89)

Panel D: Endogenous Determination of Institutional Shareholdings Examination

Model

IS_QFII

Pre-deregulation

Post-deregulation

IS

t

*X

t3

0.057

a

(2.89)

-0.020

(-0.46)

0.118

a

(3.60)

QFII

t

*IS

t

*X

t3

-0.003

(-0.54)

0.010

(1.18)

-0.010

a

(-3.19)

Legends:

1. X

t3

: the sum of earnings per share for year

t

+1 thuough

t

+3, deflated by the stock price at the

beginning of year

t

. IS

t

: income smoothing measure. VR

t

: variance ratio to proxy for income

smoothing. QFII

t

: the percentage of qualified foreign institutional shareholdings. QFII_HH

t

: dummy

variable (1 if the firm with high qualified foreign institutional shareholdings and high qualified foreign

institutional shareholdings volatility, 0 otherwise). QFII_HL

t

: dummy variable (1 if firms with high

qualified foreign institutional shareholdings and low qualified foreign institutional shareholdings

volatility, 0 otherwise). QFIT

t

: the percentage of qualified foreign institutional shareholdings.

2. “a” and “b” denote the significance on 1% and 5% levels respectively, based on two-tailed tests.

^

^