以綠色導向政策探討低經濟價值再生材料之回收供應鏈

170

supply chain and the environment as well as profits of all agents in a sense of Nash

equilibrium. We will characterize the decision impact to material suppliers and social welfare

in this section.

We analyze the effectiveness of policy frameworks in which governments do not clearly

define the bottom line for the minimum amount of EDRMs to be used. To prove the

effectiveness, the results of the tax-subsidy mechanism are compared to the situation with no

government intervention.

The following policy frameworks are considered: (1) (0S) no recycling is performed;

(2) (2S

–

) a recycling system without subsidy implemented; (3) (2S) a subsidy is given to the

EDRM supplier and product value remains unchanged. The first two frameworks are merely

for benchmarking purpose, and they are able to show the effectiveness of the taxes and

subsidies.

We first investigate a base model with only a virgin material supplier. In this base

model, a supply chain does not recycle and involves manufacturing activity only.

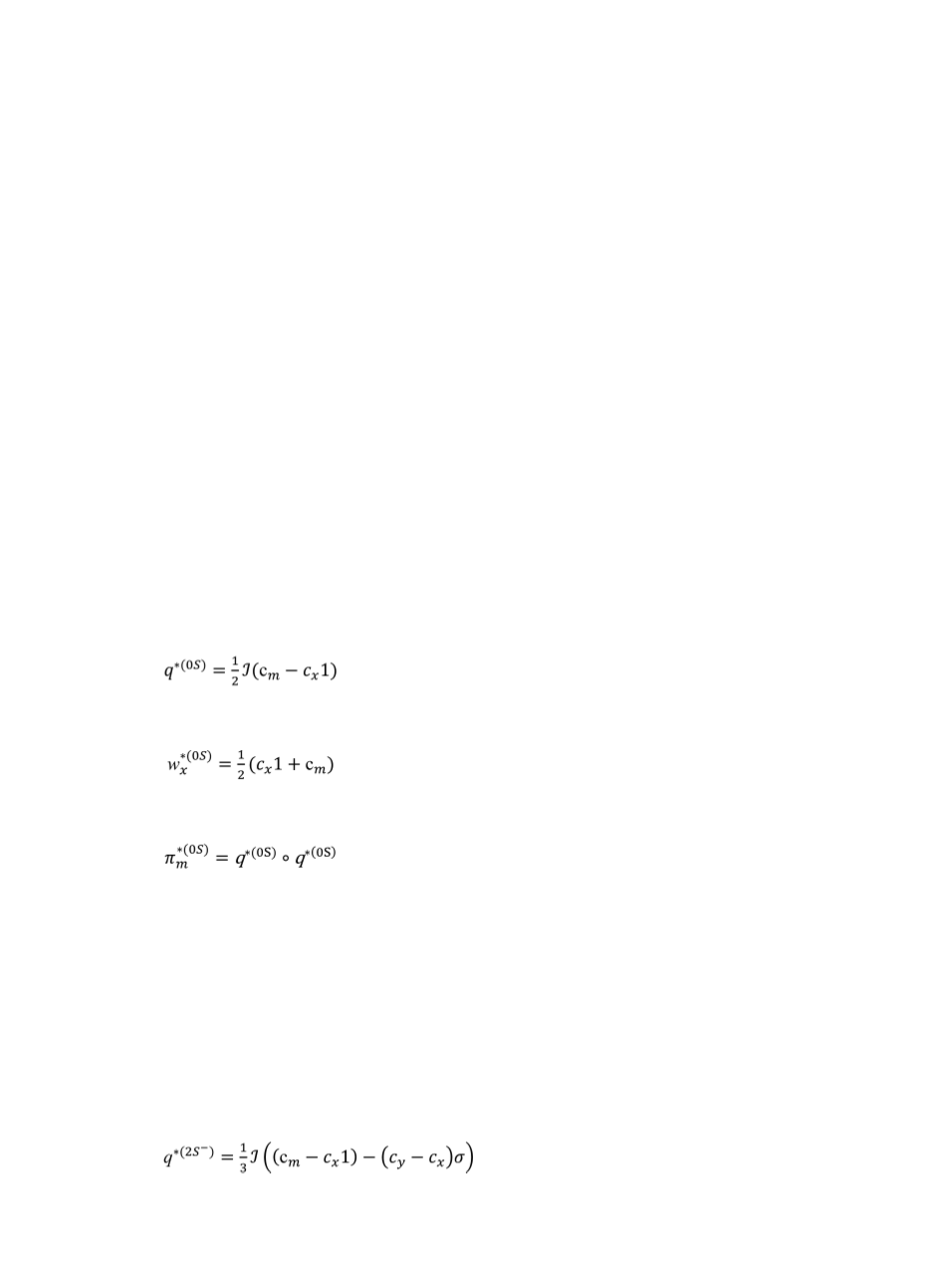

Lemma 1

. ((0S)

virgin material only

). The optimal sales quantities for manufacturers

are

(1)

The optimal wholesale prices of virgin material for manufacturers are

(2)

The optimal wholesale prices of virgin material for manufacturers are

(3)

From Lemma 1, it follows that higher manufacturing cost and material cost make the

supplier raise the wholesale price and the manufacturers will produce more quantity to

compensate the cost increase. Because of our simplification and derivation, all manufacturer

profits in the consequent analysis become a quadratic form of production quantities. For

comparison purpose, the next analysis discusses the supply chain behavior under which the

EDRM supplier competes with a virgin material but no tax-subsidy mechanisms in place (2S

–

).

Lemma 2

. ((2S

–

)

two suppliers without subsidy

). The optimal sales quantities for

manufacturers are

(4)