Page 183 - 35-1

P. 183

NTU Management Review Vol. 35 No. 1 Apr. 2025

Both datasets are publicly available on their respective websites. Financial metrics,

including SPIs and other data, are obtained from Compustat and CRSP. The final sample

comprises 296,733 firm-quarter observations for testing H1. Owing to the requirement of

voluntary non-GAAP earnings disclosures, the observations for testing H2 are 44,632.

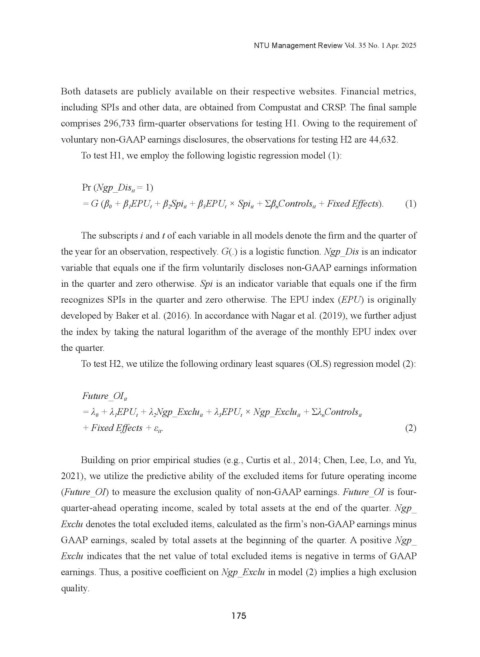

To test H1, we employ the following logistic regression model (1):

Pr (Ngp_Dis = 1)

it

= G (β + β EPU + β Spi + β EPU × Spi + Σβ Controls + Fixed Effects). (1)

it

0

3

t

1

2

t

it

n

it

The subscripts i and t of each variable in all models denote the firm and the quarter of

the year for an observation, respectively. G(.) is a logistic function. Ngp_Dis is an indicator

variable that equals one if the firm voluntarily discloses non-GAAP earnings information

in the quarter and zero otherwise. Spi is an indicator variable that equals one if the firm

recognizes SPIs in the quarter and zero otherwise. The EPU index (EPU) is originally

developed by Baker et al. (2016). In accordance with Nagar et al. (2019), we further adjust

the index by taking the natural logarithm of the average of the monthly EPU index over

the quarter.

To test H2, we utilize the following ordinary least squares (OLS) regression model (2):

Future_OI it

= λ + λ EPU + λ Ngp_Exclu + λ EPU × Ngp_Exclu + Σλ Controls

t

3

it

it

n

it

0

t

1

2

+ Fixed Effects + ε . (2)

it

Building on prior empirical studies (e.g., Curtis et al., 2014; Chen, Lee, Lo, and Yu,

2021), we utilize the predictive ability of the excluded items for future operating income

(Future_OI) to measure the exclusion quality of non-GAAP earnings. Future_OI is four-

quarter-ahead operating income, scaled by total assets at the end of the quarter. Ngp_

Exclu denotes the total excluded items, calculated as the firm’s non-GAAP earnings minus

GAAP earnings, scaled by total assets at the beginning of the quarter. A positive Ngp_

Exclu indicates that the net value of total excluded items is negative in terms of GAAP

earnings. Thus, a positive coefficient on Ngp_Exclu in model (2) implies a high exclusion

quality.

175