Page 21 - 34-1

P. 21

NTU Management Review Vol. 34 No. 1 Apr. 2024

, the correlation between two and the second row means the SAE of

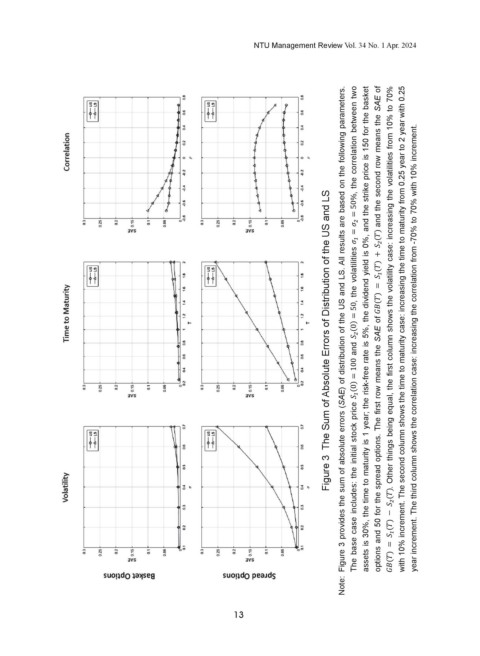

Figure 3 The Sum of Absolute Errors of Distribution of the US and LS

, the volatilities . Other things being equal, the first column shows the volatility case: increasing the volatilities from 10% to 70%

and Note: Figure 3 provides the sum of absolute errors (SAE) of distribution of the US and LS. All results are based on the following parameters. assets is 30%, the time to maturity is 1 year; the risk-free rate is 5%, the dividend yield is 0%, and the strike price is 150 for the basket options and 50 for the spread options. The first row m

13 The base case includes: the initial stock price