沙賓法

404

條及審計準則第

5

號是否會減少內部控制揭露錯誤?

280

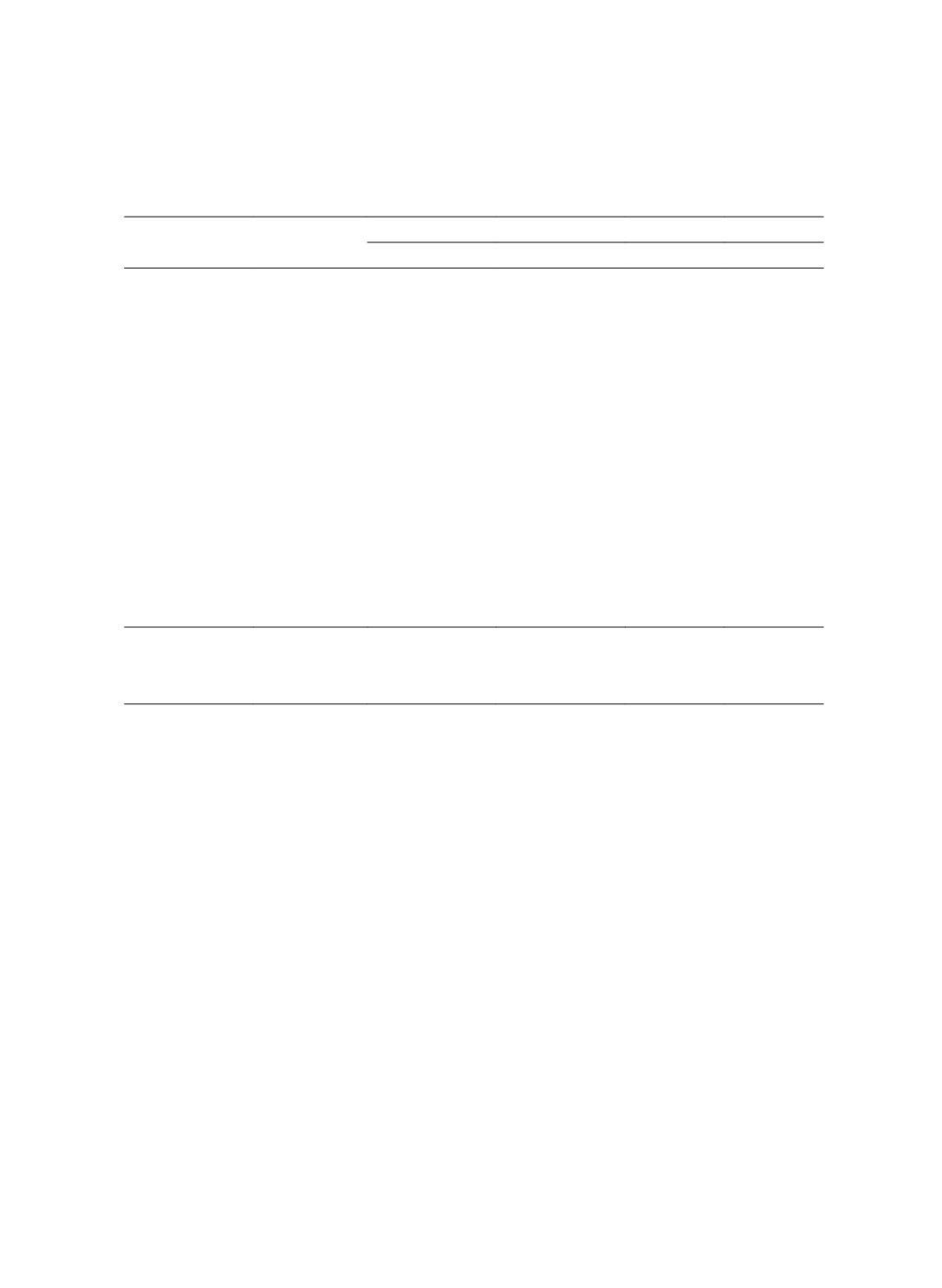

Table 10 Logistic Regression for High-AQ and Low-AQ Samples

(Dependent Variable =

EFFECTIVE

)

Predicted Sign

Low-AQ Sample

High-AQ Sample

Coefficient

p-value

Coefficient

p-value

AS5

?

1.205

0.001

2.395

<0.001

SIZE

+

0.024

0.790

-0.044

0.591

ROA

+

0.073

0.850

-0.615

0.312

LEV

-

-0.174

0.438

-0.400

0.169

PE

-

-0.001

0.579

0.000

0.831

MB

-

0.024

0.113

0.010

0.572

BIGN

?

0.347

0.137

0.550

0.036

RCP

-

-0.013

<0.001

-0.001

0.778

FT

-

-0.116

0.520

-0.574

0.001

AGLOSS

-

-0.288

0.174

-0.944

<0.001

MARKETCAP

+

0.000

0.001

0.000

0.002

CONSTANT

14.215

0.974

15.934

0.979

YEAR

(include)

(include)

INDUSTRY

(include)

(include)

LR chi squared

182.21

<0.001

267.99

<0.001

Pseudo R

2

0.123

0.148

Sample size

3375

4795

Note: Variables are defined in Table 2. P-values are based on two-tailed tests.

5.2 Period of Financial Restatements

Doyle et al. (2007a) have argued that, on average, material weaknesses exist for

several years before they are reported. In other words, restatements announced in year

t

+1

might imply the existence of weaknesses not only in year

t

+1 but also in year

t

. Therefore,

in this sensitivity test, we define restatement companies as companies that restate either

their year

t

or year

t

+1 financial statements. We replicate the analyses using the alternative

definition of restatement companies. The results are very similar to our main results,

indicating that our main results are robust to the different choices regarding the periods of

restatements. For brevity, the tables of the results are omitted.