銀行業資訊科技支出之價值攸關性

48

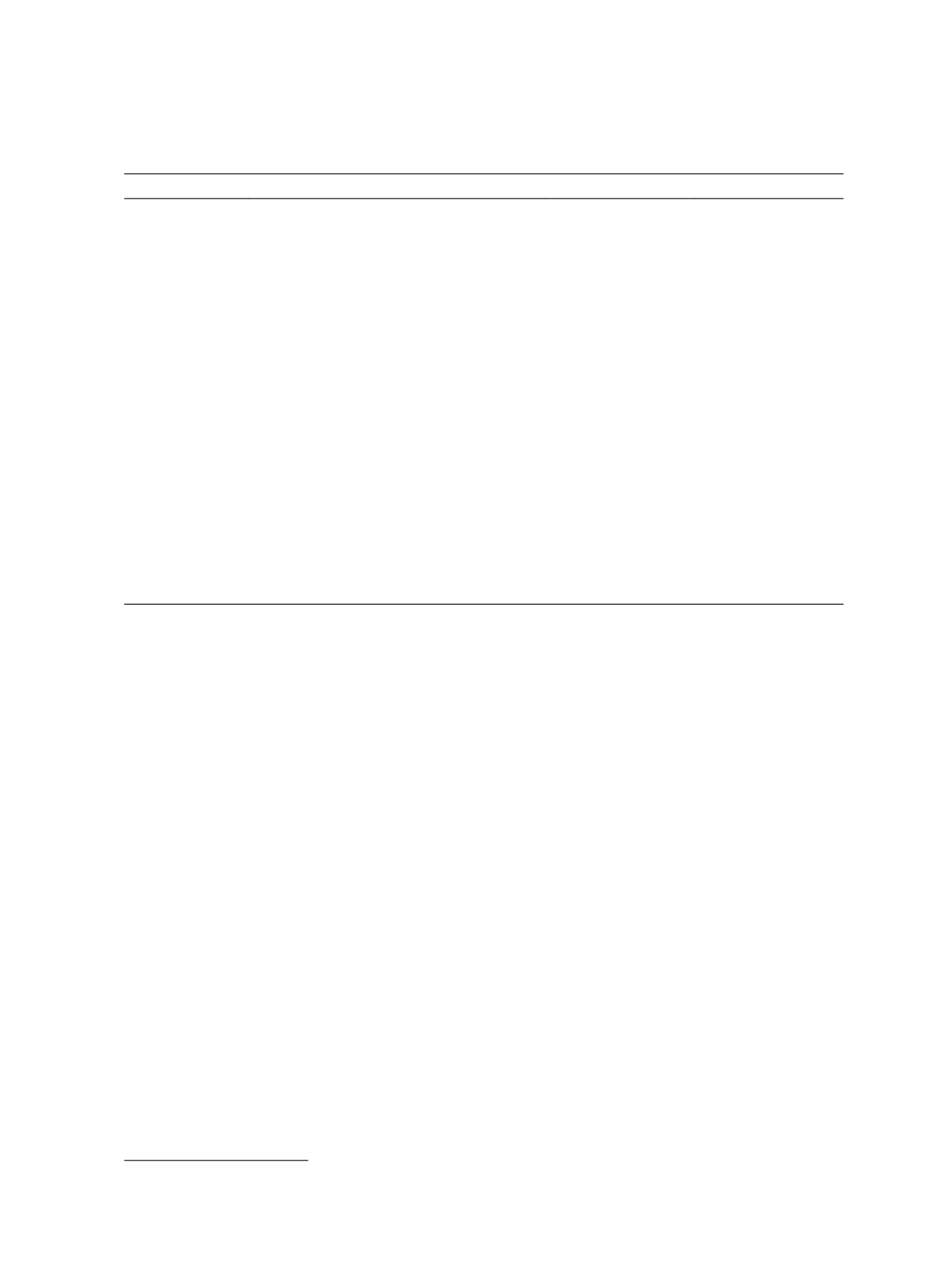

Table 5 The Value Relevance of IT Expenditure and Intensity

(1) Model 1.1

(2) Model 1.2

(3) Model 2.1

(4) Model 2.2

Dependent Var.

MV

it

MV

it

MV

it

MV

it

IT

it

2.034***

(0.001)

0.157

(0.661)

BV

it

0.906***

(0.000)

0.906***

(0.000)

0.905***

(0.000)

0.895***

(0.000)

NI

it

1.878***

(0.000)

1.870***

(0.000)

1.414***

(0.000)

BNI

it

1.877***

(0.000)

ITD

it

×NI

it

2.191***

(0.002)

ITD

it

0.002

(0.200)

-0.015**

(0.011)

Intercept

0.050***

(0.000)

0.050***

(0.001)

0.053***

(0.000)

0.056***

(0.000)

Adj-R

2

60.80%

60.80%

60.73%

62.67%

No. of obs.

2,952

2,952

2,952

2,952

a: All coefficients and p values are estimated based on double-clustered (year and firm) standard

errors. Refer to Tables 3 and 4 for variable definitions.

b: p values are presented in parentheses. *:

p

< 0.10; **:

p

< 0.05; ***:

p

< 0.01.

4.3 Robustness Checks

We apply another specification to evaluate the ability of IT intensity in improving

earnings’ persistence. In Table 6, one-year-ahead ROA (ROE, or Net income) is regressed on

the current IT intensity, current ROA (ROE, or Net income), and the related interaction

terms.

15

As shown, in Column (1), the coefficient of the interaction term between IT intensity

and current ROA (ITD

it

×ROA

it

) is positive and significant (coefficient = 0.006 and

p

=

0.000). Similarly, in Columns (2) and (3), both ITD

it

× ROE

it

and ITD

it

× NI

it

are significantly

positive (

p

< 0.001). Hence, this additional test further reveals that firms can improve the

persistence of their earnings by allocating more resources to IT infrastructures.

Some may argue that the effect of IT expenditures on performance measures should be

non-linear. Such conjecture is reasonable because the IT spending may be considerable in

certain cases. Therefore, following prior studies that focus on the non-linearity of a certain

variable (Belderbos, Carree, Diederen, Lokshin, and Veugelers, 2004; Davis, Soo, and

Trompeter, 2009), the squared terms of IT related variables are added to our original

regressions, and the results are reported in Table 7. In Column (1) where the one-year-ahead

15 The specification is adopted from Gu (2005).