臺大管理論叢

第

27

卷第

3

期

121

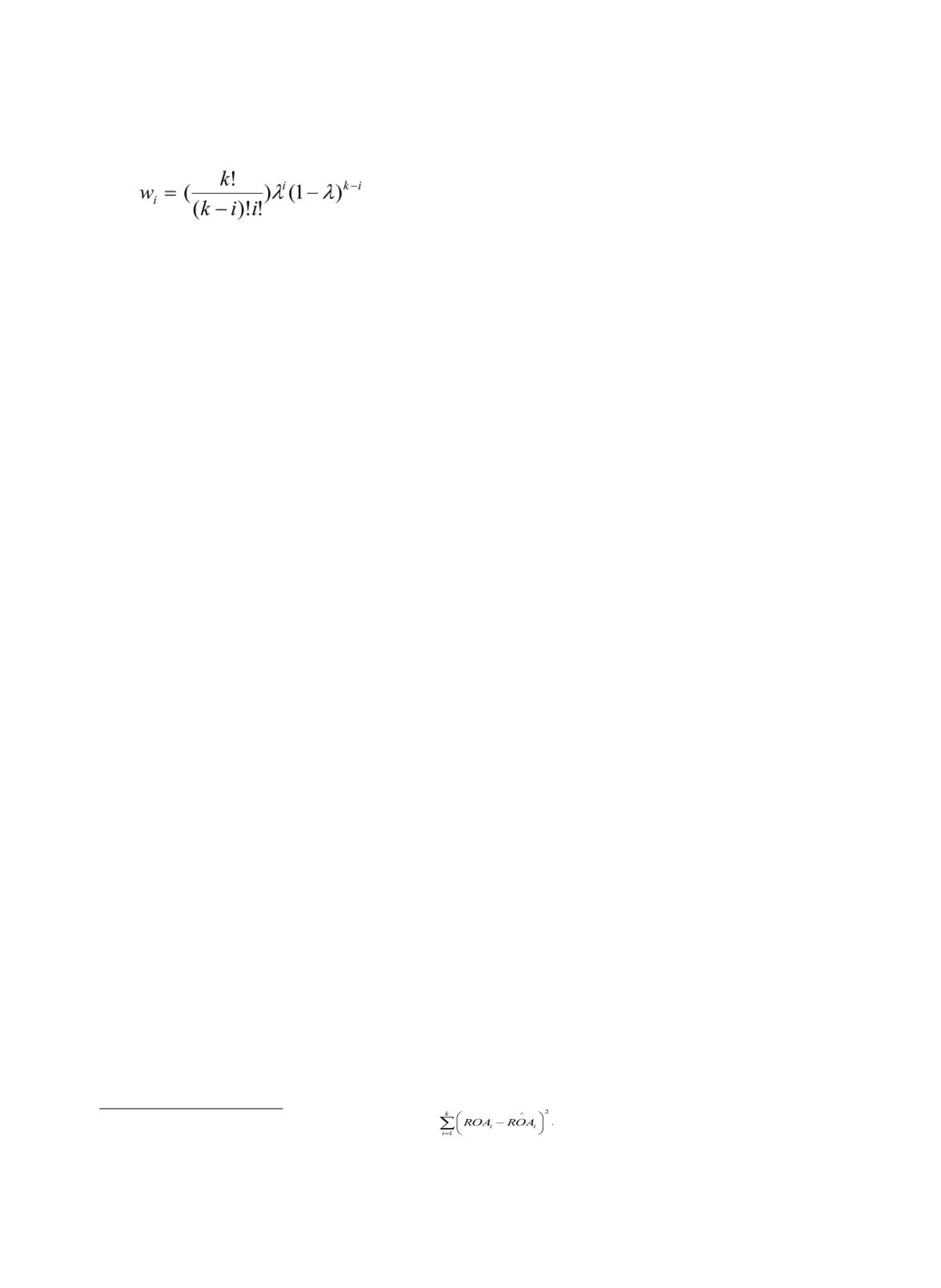

(2)

where

λ

is the binomial parameter.

The regression model for performance (return on assets) can thus be stated as:

ROA

it

=

b

1

Exploitation

+

b

2

Prior Exploitation

+

b

3

Exploitation

+

b

4

Controls

+

ɛ

(3)

The introduction of the parameter

λ

added one degree of freedom to the model. By

minimizing the sum of the squared residuals,

3

an optimal

λ

could be found. As a result, the

distribution of

W

i

and the lag structure of

Prior Exploration

could be determined.

A multivariate linear regression procedure was then adopted. The model takes account

of both time and firm-specific fixed effects to control for unobservable effects. Following

Ravenscraft and Scherer (1982), we set

k

= 8,

4

i.e., the lag period was from

t

-8 to

t

-1.

4. Results

By minimizing the sum of the squared residuals in equation (3), the optimal value for

λ

was found to be 0.2680. Substituting

λ

into equation (2), we calculated the values for w

0

to

w

7

as 0.0824, 0.2414, 0.3094, 0.2265, 0.1037, 0.0304, 0.0056 and 0.0006, respectively. The

value for

prior exploration

was thus derived from equation (1).

This result presents a bell-shaped exploration distribution with more of the lag effect

found between year 2 (weighted by w

1

) and year 5 (weighted by w

4

), suggesting that the time

lag between the beginning of exploratory investments and the commercialization of such

investments in the semiconductor industry was 2 to 5 years. This finding is consistent with

evidence from prior studies as well as field experience. Previous research has found that for

the two-digit SIC electrical and electronics industry (SIC 36), the lag period for having a

major impact is about 3 to 5 years (Lev and Sougiannis, 1996). The semiconductor industry

is one of the most technology-intensive of the SIC 36 industries. Thus, a relatively long lag

period, such as the 3 to 5 years is to be expected. As predicted by the famous Moore’s Law,

3 The sum of squared residuals was calculated as

4 We also tested multivariate linear regression results for k = 6 and k = 7, these robustness tests produce

consistent results; the sign and significance of variables were unchanged.