臺大管理論叢

第

26

卷第

2

期

13

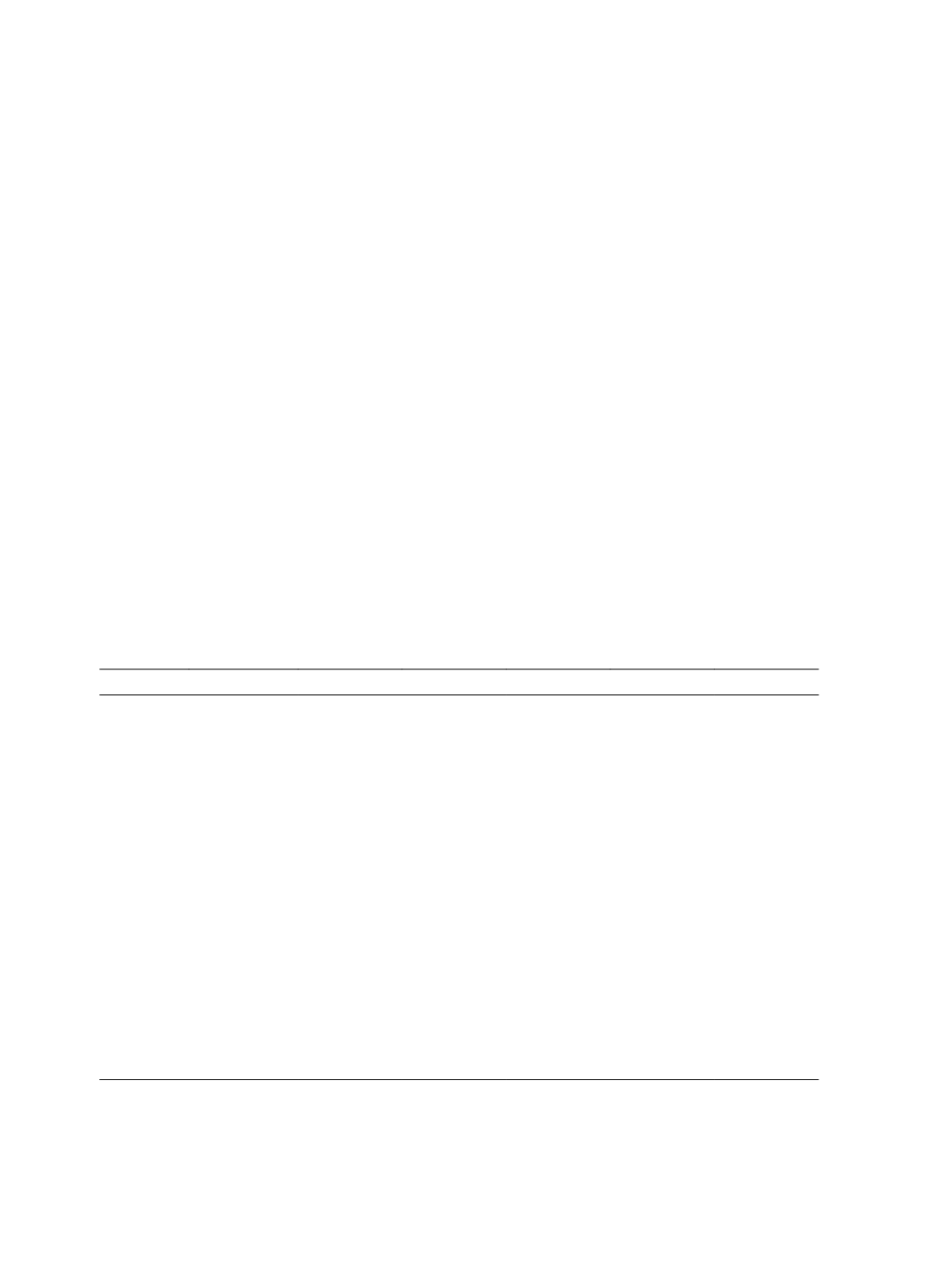

4.2 Descriptive Statistics

Table 3 provides descriptive statistics for all the variables included in the regression

model. With respect to tax avoidance variables, this study uses three measures:

BETR

,

CETR,

and

BTD

. The mean (median) value of

BETR

is 0.1932 (0.1802), the mean (median) of

CETR

is 0.2614 (0.2836) and the mean (median) of

BTD

is 17.1185 (17.1277). Both the

mean and median values of tax avoidance variables show that the level of listed Chinese

companies’ tax avoidance is relative high. Among the auditor industry expertise variables,

Table 3 shows that the mean (median) value of

IMS

is 0.0491 (0.0257) and the mean

(median) value of

IPS

is 0.0978 (0.0552). This indicates that the level of audit firms’ industry

specialization is still low based on industry market share and industry portfolio share. The

mean values of

IMS_D

and

IPS_D

are 0.1301 and 0.0980, which means that 13.01% and

9.8% of our observations are audited by industry experts. Both the continuous variables and

dummy variables show that a small proportion of auditors have developed industry expertise

in the Chinese setting. Descriptive statistics of control variables are basically consistent with

previous studies.

Table 3 Descriptive Statistics

Variables

Observations

Mean

Std

Min

Median

Max

BETR

7692

0.1932

0.0101

0

0.1802

0.7750

CETR

7692

0.2614

0.0120

0

0.2836

0.5487

BTD

7692

17.1185

3.3688

0.8663

17.1277

25.1400

IMS

7692

0.0491

0.0043

0

0.0257

0.8224

IMS_D

7692

0.1301

0.1132

0

0

1

IPS

7692

0.0978

0.0112

0.0200

0.0552

0.9434

IPS_D

7692

0.0980

0.0884

0

0

1

Fee

7692

0.0303

0.0064

0.0001

0.0121

0.9998

Tenure

7692

3.3796

7.9234

1

2

16

Big10

7692

0.4610

0.2485

0

0

1

Soe

7692

0.4303

0.2452

0

0

1

Size

7692

21.6551

1.8245

13.0760

21.5126

28.2821

Roa

7692

0.0518

0.0080

-0.4984

0.0479

0.9797

Lev

7692

0.4411

0.0514

0.0071

0.4407

0.9897

CFO

7692

0.0463

0.0089

-0.4795

0.0454

0.9601

Table 4 reports the descriptive statistics of auditor industry expertise based on industry

market share (

IMS

). This study finds that the highest audit firm market share in most of these