臺大管理論叢

第

26

卷第

2

期

11

BETR

=

β

0

+

β

1

Spec

+

β

2

Fee

+

β

3

Tenure

+

β

4

Spec

*

Fee

+

β

5

Spec

*

Tenure

+

β

6

Big10

+

β

7

Soe

+

β

8

Size

+

β

9

ROA

+

β

10

Lev

+

β

11

CFO

+

Year

+

IND

+

ε

(1)

CETR

=

β

0

+

β

1

Spec

+

β

2

Fee

+

β

3

Tenure

+

β

4

Spec

*

Fee

+

β

5

Spec

*

Tenure

+

β

6

Big10

+

β

7

Soe

+

β

8

Size

+

β

9

ROA

+

β

10

Lev

+

β

11

CFO

+

Year

+

IND

+

ε

(2)

BTD

=

β

0

+

β

1

Spec

+

β

2

Fee

+

β

3

Tenure

+

β

4

Spec

*

Fee

+

β

5

Spec

*

Tenure

+

β

6

Big10

+

β

7

Soe

+

β

8

Size

+

β

9

ROA

+

β

10

Lev

+

β

11

CFO

+

Year

+

IND

+

ε

(3)

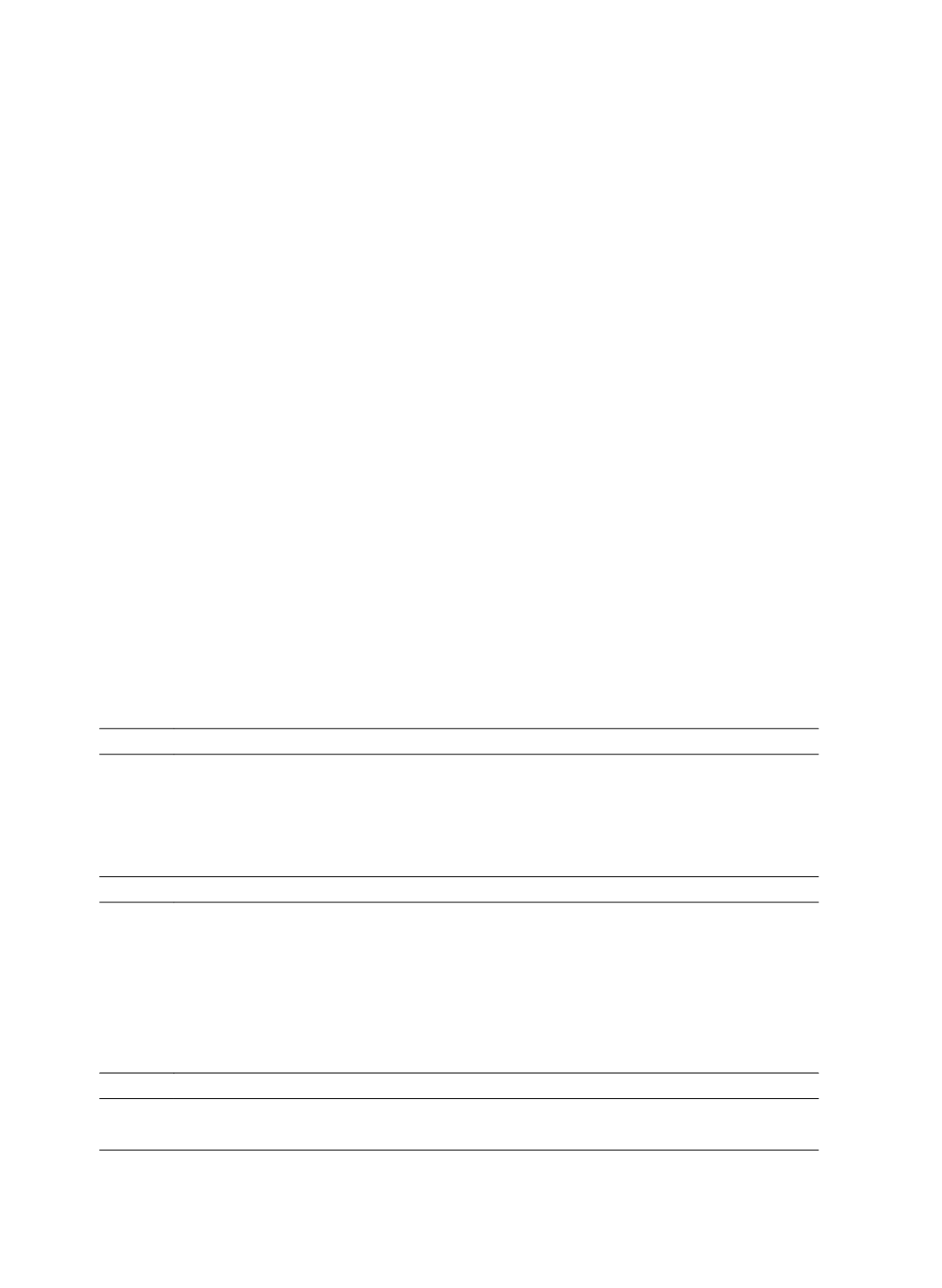

where tax avoidance is measured by

BETR

,

CETR

and

BTD

, and auditor industry

expertise (

Spec

) is measured by

IMS

,

IMS_D

,

IPS

and

IPS_D

. We also use fee dependence

and auditor tenure to proxy for auditor independence. Fee dependence (

Fee

) is measured by

the ratio of a particular client’s total fees given over all total fees received by the audit firm

during a one-year period. This proxy can capture the relative significance of a client’s total

fees to the fee revenue received by the auditor, as a measure to capture economic bonding

between the auditor and the clients (Stice, 1991). Auditor tenure is measured by the length of

the auditor–client relationship (Myers, Myers, and Omer, 2003; Ghosh and Moon, 2005).

Prior research suggests that longer auditor tenure represents poor auditor independence

(Hoyle, 1978). All variables are defined in table 1.

Table 1 Variable Measurement

Measures of Tax Avoidance (

Tax-avoidance

)

BETR

= current income tax expense divided by pre-tax accounting income less special items.

ETRs

with negative denominators are deleted.

CETR

= cash taxes paid divided by pre-tax accounting income less special items. ETRs with

negative denominators are deleted.

BTD

= the natural log of absolute value of pre-tax book income less taxable income

Measures of Auditor Industry Expertise (

Spec

)

IMS

= the sum of sales of all

J

ik

clients of audit firm

i

in industry

k

divided by the sales of

J

ik

clients in industry

k

summed over all

I

k

audit firms in the sample with clients (

J

ik

) in

industry

k

IMS_D

= 1 when

IMS

ik

≥ 10%, otherwise 0.

IPS

= the sum of the sales of all

J

ik

clients of audit firm

i

in industry

k

divided by the sales of all

clients of audit firm

i

summed over all

k

industries.

IPS_D

= 1 when

IPS

ik

is the highest in the portfolio of audit firm

i

, otherwise 0.

Measures of Auditor Independence

Fee

= the ratio of a particular client’s total fees given all total fees received by the audit firm.

Tenure

= the length of the auditor–client relationship