Page 15 - 34-1

P. 15

Assume that trading takes place continuously over a time interval �0, �, 0 < < . The uncertainty is

� � ��, � �, where the filtration is generated by the correlated

described by a filtered probability space � , , , �ℱ �

standard Brownian motions denoted by ( , , , , , and their instantaneous correlations between

�

( and ( , , are denoted by . The measure represents the risk-neutral probability

�

�,�

�

measure.

Consider underlying assets whose dynamics under the risk-neutral probability measure are assumed to

be the following stochastic differential equations:

( , , , , ,

�� � (�

�

�

�

� � (�

where and represent the drift and diffusion terms, respectively. Their prices at time conditional on time-

�

�

0 information can be derived by using the It � Lemma as follows: 5 (1)

( (0 exp �� − � ( �. (2)

�

�

� � � � � �

�

Therefore, within the model setting, the time- price of the underlying asset follows a lognormal distribution.

NTU Management Review Vol. 34 No. 1 Apr. 2024

The model, presented by equation (1), can be straightforwardly generalized by including other risk factors,

such as stochastic interest rates (e.g., Kijima and Muromachi, 2001; Bernard, Le Courtois, and Quittard-Pinon,

price jumps (e.g., Merton, 1976; Metwally and Atiya, 2002; Flamouris and Giamouridis,

2008; Wu and Chen, 2007a, 2007b), and price jumps (e.g., Merton, 1976; Metwally and Atiya, 2002; Flamouris

2007; Ross and Ghamami, 2010). Within the framework of these two extended models,

and Giamouridis, 2007; Ross and Ghamami, 2010). Within the framework of these two extended models, the

the time-T price of the underlying asset remains a lognormal distribution, and thus, their

time- price of the underlying asset remains a lognormal distribution, and thus, their pricing methods for

pricing methods for basket/spread options are similar to those derived within the model

basket/spread options are similar to those derived within the model setting given in equation (1). Our purpose is

setting given in equation (1). Our purpose is to examine the performance of the Johnson

to examine the performance of the Johnson (1949) distribution family, which is used to approximate the

(1949) distribution family, which is used to approximate the distribution of a basket/spread

distribution of a basket/spread of underlying assets (or simply lognormal variates). Hence, to focus on the

of underlying assets (or simply lognormal variates). Hence, to focus on the purpose of

purpose of this study, we confine our model setting of the underlying assets to a geometric Brownian motion

this study, we confine our model setting of the underlying assets to a geometric Brownian

presented by equation (1).

motion presented by equation (1).

2.2. The Basket/Spread of Underlying Assets

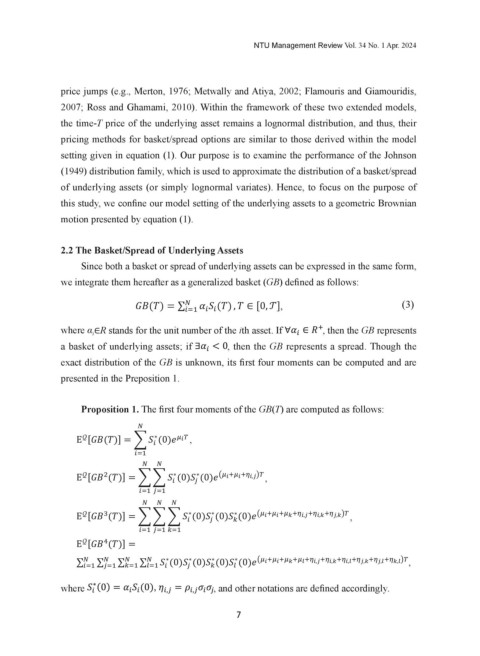

2.2 The Basket/Spread of Underlying Assets

Since both a basket or spread of underlying assets can be expressed in the same form,

Since both a basket or spread of underlying assets can be expressed in the same form, we integrate them

we integrate them hereafter as a generalized basket (GB) defined as follows:

hereafter as a generalized basket ( ) defined as follows:

� ( , �0, �, (3)

( ∑

��� � �

where α ∈R stands for the unit number of the ith asset. If , then the GB represents

i

where ∈ stands for the unit number , then the GB represents a spread. Though the a basket of

a basket of underlying assets; if of the th asset. If ∀ ∈ , then the represents a basket of

where ∈ stands for the unit number of the th asset. If ∀ ∈ , then the represents

� �

� �

� �

exact distribution of the GB is unknown, its first four moments can be computed and are of the is

underlying assets; if ∃ <0, then the represents a spread. Though the exact distribution

underlying assets; if ∃ <0, then the represents a spread. Though the exact distribution of the is

5 The model can be easily applied to a variety of underlying assets by adjusting the setting of the drift terms. For example, if stands

� �

unknown, its first four moments can be computed and are presented in the Preposition 1.

unknown, its first four moments can be computed and are presented in the Preposition 1.

presented in the Preposition 1. and � represent the domestic and foreign risk-free interest rates, respectively.

for the foreign exchange rate, then � − � , where �

If denotes an equity index, then � − , where represents the dividend yield rate. If represents a forward or futures price,

then 0, which is the same with the model setting specified in Borovkova et al. (2007). In addition, � can be replaced by a time-

varing process. Proposition 1. The first four moments of the are computed as follows:

Proposition 1. The first four moments of the GB(T) are computed as follows:

Proposition 1. The first four moments of the are computed as follows:

� � 4

∗ ∗

� �

E � � = � 0 � � � � ,

E � � = � 0

� �

���

���

� � � �

∗ ∗

� �

�� � �� � �� �,� ��

∗ ∗

E � � = � � 0 0 �� � �� � �� �,� �� ,

E � � = � � 0 0

� � � �

��� ����� ���

�

� � � � � �

∗ ∗

∗ ∗

� �

∗ ∗

�� � �� � �� � �� �,� �� �,� �� �,� ��

E � � = � � � 0 0 0 �� � �� � �� � �� �,� �� �,� �� �,� �� ,

E � � = � � � 0 0 0

� �

� �

� �

���

��� ��� ������ ���

E � �

� �

E � � = =

∗ ∗

�� � �� � �� � �� � �� �,� �� �,� �� �,� �� �,� �� �,� �� �,� ��

∗ ∗

∗ ∗

∗ ∗

∑ ∑ � � ∑ ∑ � � ∑ ∑ � � ∑ ∑ � � 0 0 0 0 �� � �� � �� � �� � �� �,� �� �,� �� �,� �� �,� �� �,� �� �,� �� , ,

0 0 0 0

���

���

���

��� ��� ��� ��� � � � � � � � �

���

= , and other notations are defined accordingly.

∗ ∗

where 0 = 0 , = , and other notations are defined accordingly.

�,� �

where 0 = 0 , �,�

� � where � � � � �,� �,� � � � , and other notations are defined accordingly.

Based on Proposition 1 and some statistical computation, the mean (ℳ), variance ( ), skewness ( ), and

Based on Proposition 1 and some statistical computation, the mean (ℳ), variance ( ), skewness ( ), and

kurtosis ( ) of the can be derived as follows:

kurtosis ( ) of the can be derived as follows: 7

ℳ =E � �, (4)

(4)

ℳ =E � �,

=E � ℳ �, �, (5)

(5)

� �

=E � ℳ

ℳ � �

ℳ

(6)

�

= E � �, �, (6)

= E �� ��

√

√

ℳ 4 4

ℳ

(7)

= E � �, �, (7)

= E �� ��

�

√

√

These four characteristics can be exactly computed using present market data.

These four characteristics can be exactly computed using present market data.

2.3. The Johnson Distribution Family

2.3. The Johnson Distribution Family

The Johnson (1949) distribution family is a collection of probability distributions, which are transformed

The Johnson (1949) distribution family is a collection of probability distributions, which are transformed

from standard normal distributions via three types of functions with four parameters. Let stand for a standard

from standard normal distributions via three types of functions with four parameters. Let stand for a standard

normal distribution and denote a Johnson distribution. The relation between and is presented by:

normal distribution and denote a Johnson distribution. The relation between and is presented by:

(8)

= � �

= �, �, (8)

where is a location parameter, is a scale parameter, and and are shape parameters. The transformation of

where is a location parameter, is a scale parameter, and and are shape parameters. The transformation of

a standard normal distribution, denoted by , falls into three types: a lognormal system, an unbounded system,

a standard normal distribution, denoted by , falls into three types: a lognormal system, an unbounded system,

and a bounded system, which are specifically presented as follows:

and a bounded system, which are specifically presented as follows:

5 5